Earning Yield on Bitcoin: The Future of BTC in DeFi

Bitcoin (BTC) has long been known as a store of value, celebrated for its scarcity and security. However, in today’s rapidly evolving DeFi (decentralized finance) landscape, Bitcoin’s role is expanding beyond simply being “digital gold.”

Through innovative DeFi mechanisms, BTC holders can now transform their idle assets into yield-generating tools, maximizing returns while maintaining exposure to price movement. This shift is one of the potential driving factors behind BTC’s incredible performance, as its market dominance recently reached 58%, the highest since April 2021.

This rise in Bitcoin’s dominance reflects the growing confidence in BTC not only as a store of value but also as a productive asset in the BTCfi ecosystem. Thankfully, with a recent integration to our protocol, Davos users can now leverage BTC derivatives, such as Avalon wBTC, to mint DUSD and unlock multiple layers of yield and potential rewards. Let us take a look we got here and how you can make your idle BTC

Bitcoin’s Traditional Role as a Store of Value

Bitcoin was introduced by Satoshi Nakamoto as a decentralized, peer-to-peer currency, designed to provide financial sovereignty outside of centralized systems. Satoshi’s creation signaled a departure from traditional finance, as many people were disillusioned with banks and financial institutions following the 2007-2008 financial crisis.

Bitcoin’s fixed supply and robust security model led to it being dubbed “digital gold,” making it a valuable long-term store of wealth. For much of its history, holders ("HODLers") viewed Bitcoin as an asset to accumulate and hold over time.

However, this traditional view limited the currency’s potential as a productive asset capable of generating returns. With BTCfi’s rise, that perspective is changing. BTCfi has opened up new avenues, enabling Bitcoin holders to put their assets to work while retaining ownership.

The Rise of DeFi and Yield Opportunities for Bitcoin Holders

DeFi has revolutionized the crypto space, creating decentralized, permissionless financial services that allow users to borrow, lend, trade, and earn yield. For Bitcoin holders, this presents a new opportunity.

Through the development of wrapped Bitcoin derivatives, BTC can now be utilized on Ethereum-compatible blockchains and DeFi platforms.

Wrapped Bitcoin, such as Avalon wBTC on BitLayer, allows users to mint stablecoins like DUSD on Davos Protocol, opening the door to earning yield on idle BTC. This method keeps the original BTC intact while turning it into a yield-bearing asset, revolutionizing Bitcoin’s use case from passive to productive.

Check out our blog post for a broader overview on BTCfi:The Rise of BTCfi: How Bitcoin is Entering the Defi Space.

How to Earn Yield on Bitcoin with Davos Protocol

Step 1: Convert Bitcoin into a BTC Derivative

The first step in leveraging Bitcoin for yield in DeFi is to convert it into a wrapped BTC derivative. Avalon wBTC, a derivative available on the BitLayer network, allows BTC to be represented as an ERC-20 token. This makes it compatible with Ethereum-based DeFi protocols, including Davos.

By converting BTC to Avalon wBTC, users bring their Bitcoin into the EVM-compatible space, enabling it to be utilized for minting stablecoins or earning yield through various DeFi protocols.

Step 2: Use BTC Derivative as Collateral on Davos Protocol

Once you have Avalon wBTC, you can use it as collateral on Davos Protocol to mint DUSD, our algorithmic stablecoin. This allows you to unlock liquidity without selling your Bitcoin. As a result, you can continue benefiting from BTC’s price movements while putting your assets to work.

By minting DUSD, users maintain their Bitcoin exposure but gain the flexibility to participate in yield farming and staking opportunities, turning their Bitcoin into a dynamic asset.

Earning Yield with DUSD on Davos Protocol

Yield Farming with DUSD

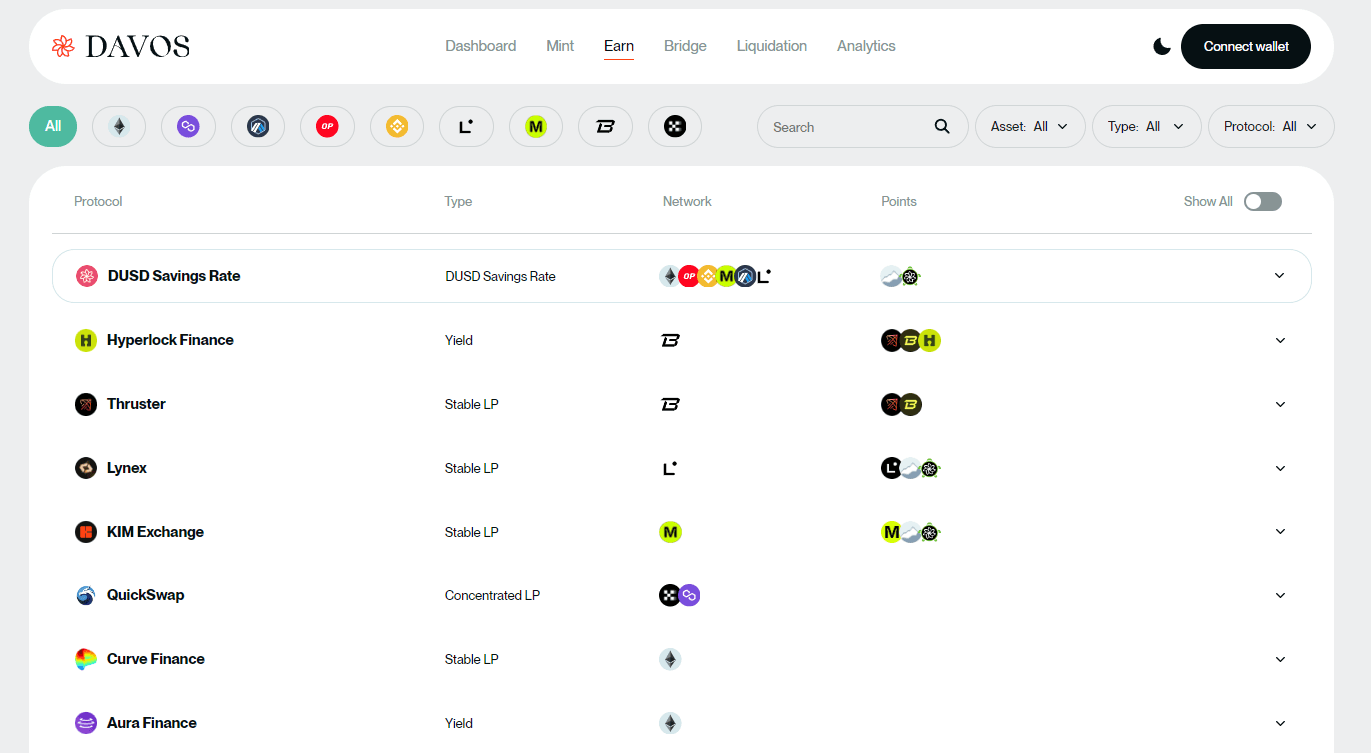

After minting DUSD, users can deploy it in yield farming pools across decentralized platforms integrated with Davos. By contributing liquidity or staking DUSD, users can earn yield from transaction fees, liquidity incentives, or farming rewards. There are several DeFi platforms where you can stake DUSD and earn yield on your holdings, maximizing returns from your initial Bitcoin investment.

Davos dApp Earn Page, with all DUSD Defi Integrations (Source)

Davos dApp Earn Page, with all DUSD Defi Integrations (Source)

Staking DUSD in the Savings Rate

Davos also offers a Savings Rate feature, where users can stake their DUSD to earn predictable and sustainable returns. These yields come from the protocol’s revenue redistribution, ensuring a stable, lower-risk yield generation option. For users seeking a more predictable income stream from their Bitcoin, staking DUSD in the Savings Rate is an attractive option.

For the full scoop on how the Davos Savings Rate works, check out our blogpost about it: Unlock Passive Income with Davos Savings Rate

Why Use Davos for Bitcoin Yield Generation?

Unlocking Multiple Layers of Yield

Davos allows BTC holders to generate yield at multiple levels, optimizing their capital efficiency:

1. BTC to Avalon wBTC: Maintain exposure to Bitcoin’s price movements.

2. wBTC to DUSD: Unlock liquidity by minting a stablecoin without selling your Bitcoin.

3. DUSD to Yield: Deploy DUSD for yield farming or staking to earn returns.

This multi-layered approach maximizes your ability to generate returns while keeping your Bitcoin productive.

Predictable vs. Dynamic Yield Options

At Davos, users can choose between dynamic yield farming opportunities, where returns fluctuate based on market conditions, or predictable, stable returns through the Savings Rate. This flexibility allows users to balance risk and reward according to their financial goals.

Capital Efficiency

The ability to collateralize Bitcoin without selling it and mint DUSD gives BTC holders a way to make their capital work harder. This strategy allows you to earn yield without sacrificing your long-term Bitcoin position, making your portfolio more efficient.

Putting it all together

We are paving the way for Bitcoin holders to maximize the potential of their assets in the DeFi space. Through the BTC -> Avalon wBTC -> DUSD workflow, users can generate consistent returns while keeping their Bitcoin exposure intact. Whether you’re interested in complex yield farming strategies or the predictability of our Savings Rate, Davos provides the tools to broaden access to BTCfi opportunties. Start by converting your BTC into Avalon wBTC, mint DUSD, and explore the full range of yield-generating options we have to offer. Propel your DeFi journey with Davos today.