Announcing ezETH on Davos: A New Era for Collateral Utility

We are thrilled to announce the integration of ezETH into Davos Protocol! Now our users can collateralize their ezETH to mint DUSD and explore more DeFi opportunities on top of their two layers of rewards.

With Eigenalyer reshaping the foundation of the Staking space, Liquid Restaking Protocols are rapidly expanding. Renzo is at the forefront of this new wave, introducing ezETH, a significant Liquid Restaking Token (LRT) that captures the essence and rewards of Ethereum L1 Staking and Restaking.

This article looks into Renzo’s critical role in developing the Defi landscape and discusses the unique benefits of this relationship

TL;DR:

- Davos introduces ezETH collateralization, which improves its DeFi offerings on Ethereum and other EVM-supported chains.

- ezETH, by Renzo, is a native liquid restaking token that represents staked Ethereum plus staking rewards.

- This integration expands ezETH's utility and solidifies Davos' role in pioneering Defi solutions, providing unparalleled earning opportunities for its users.

Empowering Ethereum Restaking with Renzo and ezETH

Renzo is the second-largest liquid restaking protocol, boasting over $2.37 billion in TVL (Total Value Locked).

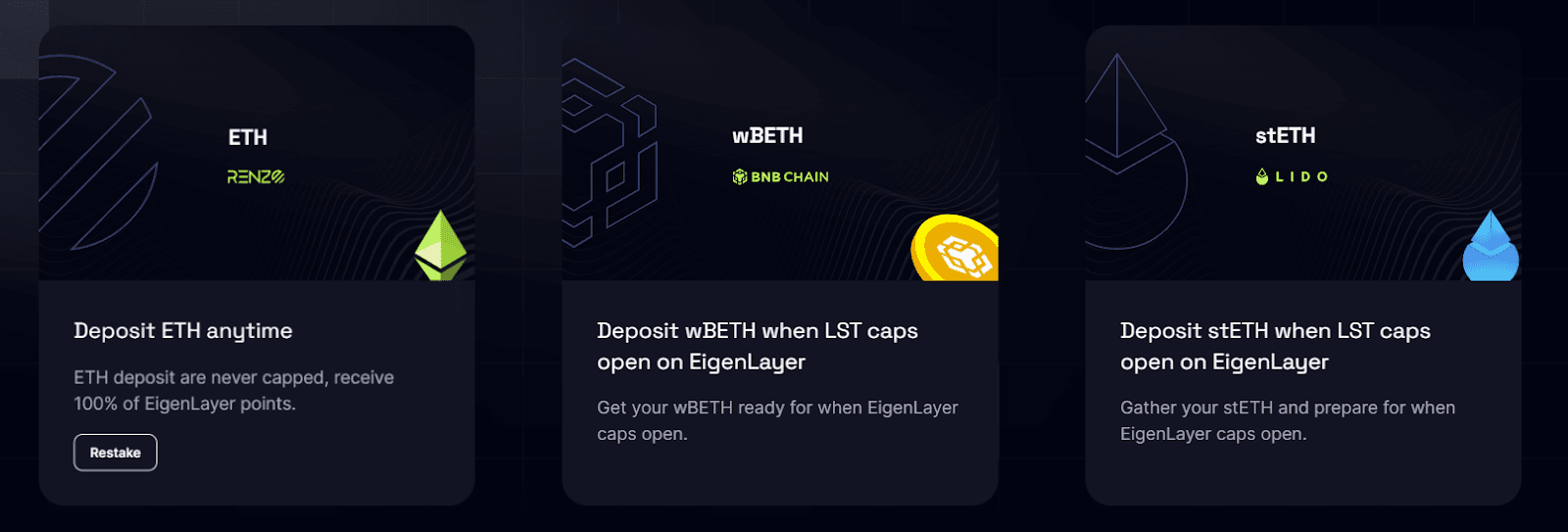

Thanks to an integration with EingenLayer, Renzo allows users to restake native ETH and other liquid staking tokens (wBETH, stETH) while maintaining control over their private keys.

[1] - Renzos Restaking Products (Source)

[1] - Renzos Restaking Products (Source)

Renzo is a supporter of EigenLayer, aiming to enable seamless innovation on Ethereum without the need for permissions and to systematically foster trust within the ecosystem. The protocol’s mission is to drive the adoption of EigenLayer and democratize staking within the Ethereum ecosystem, ensuring its accessibility and decentralization.

Highlights of Renzo:

- TVL: Approximately $2.37 billion on Ethereum, signifying robust participation and trust in the protocol.

- Staking Rewards: Offers a base APR of 2.4%, plus additional rewards via EigenLayer and Renzo ezPoints points.

- Governance: Through snapshot votes, and on-chain governance in the future, users will have the power to select AVSs (Actively Validated Services) for node operators to support.

Why ezETH?

The integration of ezETH, driven by Renzo’s extensive alliances, provides users with fresh financial strategies within the Defi ecosystem. By using ezETH as collateral on the Davos Protocol, users gain access to advanced yield farming techniques, such as leveraged looping, as well as the option to increase their earnings through the DUSD Savings Rate.

This expansion not only broadens the prospects within Defi, but also benefits the whole ecosystem by enabling more diverse and strategic asset use alternatives through Davos Protocol.

Integrating ezETH on Davos Protocol

This integration marks a milestone for Davos Protocol, attracting a high-potential asset into its ecosystem and broadening yield opportunities.

With the introduction of LRTs, Davos Protocol broadens the spectrum of choices for its participants. Given that Renzo is the second largest restaking protocol by Total Value Locked (TVL), we anticipate this collaboration to contribute substantial worth to our ecosystem, ensuring our services remain competitive and aligned with current market trends.

By focusing on assets like ezETH, anticipated to grow in value faster than other tokens that carry rewards, the Davos Protocol is paving the way for a rapid and marked enhancement of its users' Health Ratios.

How to Mint DUSD with ezETH

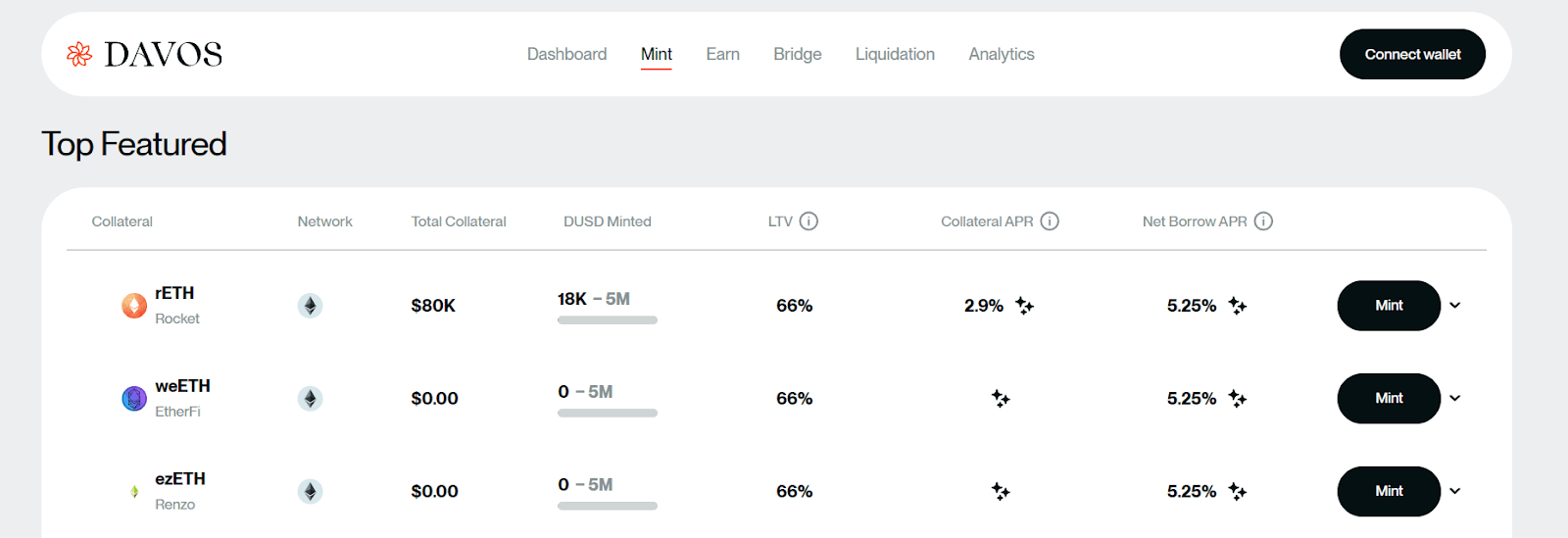

Users can mint DUSD by collateralizing ezETH on the Davos platform, benefiting from a 66% LTV (Loan-to-Value) ratio. The LTV ratio is an important aspect to keep in mind as it influences the amount of DUSD one can mint based on the ezETH collateral's value.

To mint DUSD using ezETH, users must first interact with the Renzo platform, where they can stake their ETH to mint ezETH. After acquiring ezETH, users should proceed to the Davos.xyz platform and stake ezETH as collateral, minting DUSD in the process.

[2] - ezETH as a top features minting Option on Davos Dashboard (Source)

[2] - ezETH as a top features minting Option on Davos Dashboard (Source)

Once minted, users can trade DUSD or use it to generate additional rewards, as several yield farming opportunities across different blockchains are available. Trying out different DeFi strategies becomes a breeze thanks to our no-fee bridge, which enables the transfer of DUSD to different chains with no extra charges.

Alternatively, our users can compound rewards by staking DUSD within the Davos Protocol and minting our omnichain savings rate token (sDUSD) in return. As one of our most recent financial products, sDUSD offers holders the unique opportunity of receiving a portion (5%) of earnings generated by the Davos Protocol.

All in all, taking advantage of these opportunities can greatly increase the potential profits from DeFi activities. However, it's always important to conduct thorough research and manage risk before making any decisions. While trying out multiple investment strategies might sound appealing, we advise caution when overleveraging your assets, as it could incur significant losses.

Unlock the Full Potential of Liquid Staking with Davos

This integration heralds a new chapter in DeFi, making ezETH collateralization a key offering of Davos Protocol. We aim to bring the best of DeFi to our community by continuously innovating and expanding our collateral options, offering greater stability to our stablecoin in the process.

In the upcoming weeks, we intend to expand the integration of Renzos ezETH in other chains where DUSD is available and supported. This expansion is set to open new avenues in order to maximize user investment opportunities.

Leverage the benefits of this exciting new integration and maximize your Ethereum investments by restaking with Davos today!