Announcing KelpDAO on Davos: A New Era for Collateral Utility

We are thrilled to announce a new collaboration with KelpDAO! Now our users can collateralize rsETH, KelpDAO’s liquid restaking token, to mint DUSD and explore extra staking and yield farming opportunities. In this post, we will delve into KelpDAO and highlight the key benefits of rsETH integration.

TL;DR:

- Davos introduces rsETH collateralization, building upon its DeFi journey on Ethereum and other EVM-supported chains.

- rsETH, by KelpDAO, is a native liquid restaking token that represents staked Ethereum plus staking rewards.

- This integration expands KelpDAO's utility, strengthens the stability of DUSD, and brings further composability to the DeFi ecosystem.

Welcoming KelpDAO

KelpDAO is a DeFi protocol created to advance multichain liquid restaking solutions. The platform was envisioned by Amitej G and Dheeraj B, two successful entrepreneurs who bring a wealth of DeFi experience from their previous venture, Stader Labs.

Since going live in December 2023, KelpDAO has already surpassed Stader Labs in Total Value Locked (TVL), amassing over $830 million in only a few months.

KelpDAO ensures the integrity and reliability of its services through the whitelisting of services and validators, thereby establishing a trusted ecosystem for its users. The project has also enlisted the expertise of top auditors such as Sigma Prime and code4arena, underscoring the robustness and reliability of its solutions.

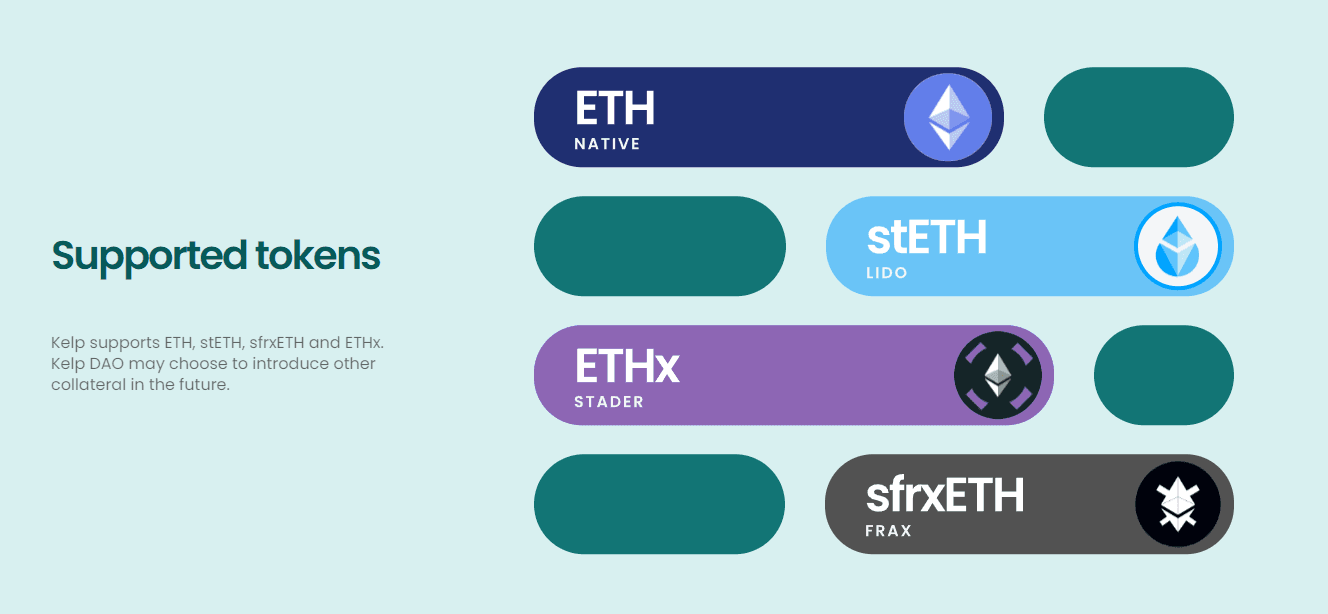

The KelpDAO platform currently supports native ETH, as well as other Liquid Staking Tokens (LSTs) from protocols such as Lido (stETH), Frax (sfrxETH), and Stader (ETHx). Each of these options would offer Kelps basket-based LRT in return.

[1] - Supported Tokens on KelpDAO (Source)

[1] - Supported Tokens on KelpDAO (Source)

Why rsETH?

At the heart of KelpDAO's innovation is the development of rsETH, a Basket-based Liquid Restaking Token (bLRT) designed to invigorate the Ethereum ecosystem.

This approach allows rsETH to combine all Liquid Staking Tokens (LSTs) and Native ETH into a single LRT token, simplifying the process and providing a complete staking and restaking solution. Such simplicity enables users to seamlessly opt-in to the protocol, removing complexity and increasing flexibility. Considering the protocol’s rapid success, it’s easy to state that these are features highly valuable to restakers.

rsETH aims to mitigate the risks and challenges endemic to the existing restaking offerings, presenting a promising avenue for Ethereum stakeholders to maximize the potential of their investments.

Integrating Kelp on Davos Protocol

This integration reflects our team’s commitment to broadening access to liquid restaking solutions. By attracting another asset into the Davos ecosystem, we are effectively contributing to a more cohesive and stable DeFi sector.

There are multiple benefits of adding several LRTs as collateral for DUSD, as it strengthens the peg of our stablecoin, brings a vast spectrum of choices to our users, and drives interest toward our omnichain product, sDUSD.

How to Mint DUSD with rsETH

The process of minting DUSD with rsETH as collateral is straightforward. First, users must own rsETH, which can be acquired by staking ETH, or any other supported LST, on the KelpDAO platform.

After acquiring rsETH, users should proceed to the Davos.xyz platform and stake rsETH as collateral, minting DUSD in the process. Once minted, DUSD holders can explore several yield farming opportunities across multiple leading blockchains.

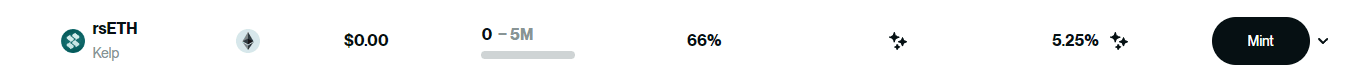

[2] - rsETH Minting Option on Davos Dapp (Source)

[2] - rsETH Minting Option on Davos Dapp (Source)

DUSD holders also become eligible to receive a portion of earnings generated by the Davos Protocol. By staking DUSD and minting our omnichain savings rate token (sDUSD) in return, investors begin earning a 5% share of the fees generated by the Davos Protocol.

Unlock the Full Potential of Liquid Restaking with Davos

rsETH collateralization will now become one of the key offerings within the Davos Protocol. This integration heralds a new chapter in our goal of unlocking the power of liquid restaking solutions.

We aim to bring the best of DeFi to our community by continuously innovating and expanding our collateral options, creating an increasingly interoperable blockchain ecosystem while simultaneously improving the stability of our DUSD stablecoin.

Leverage the benefits of this exciting new integration and maximize your Ethereum investments with Davos today!