Announcing weETH on Davos: A New Era for Collateral Utility

We are thrilled to launch a new era of digital asset collateralization with the integration of weETH into Davos Protocol.

The introduction of EigenLayer has radically altered the staking landscape, increasing scalability and encouraging the rise of Liquid Restaking Protocols.

Ether.fi is at the vanguard of the new LRT movement, having introduced weETH, a liquid restaking token that embodies Ethereum’s staking & restaking rewards. Through this collaboration, weETH’s utility is expanded and provides our user base with a prime opportunity for earning. This article will look at Ether.fi’s substantial contributions to the Defi landscape and show the advantages of this integration.

TL;DR:

- Davos introduces weETH collateralization, furthering its journey within DeFi on both Ethereum and other EVM-supported chains.

- weETH, by Ether.fi, is a native liquid restaking token that represents Ethereum’s current and future staking rewards.

- This integration amplifies the utility of weETH while also cementing Davos' position as a space pioneer, offering the best earning possibilities for its users.

Empowering Ethereum Restaking with Ether.fi and weETH

Built on the Ethereum blockchain, Ether.fi is the leading restaking protocol with over $3.1 billion in TVL (Total Value Locked).

Ether.fi offers users the opportunity to stake both native ETH and Lido’s stETH, while keeping control over their private keys. The staked assets then generate staking rewards. Restaking will also be available in the future thanks to the protocol’s integration with EigenLayer.

The goal of Ether.fi is to make staking more accessible, efficient, and decentralized within the Ethereum ecosystem. The Ether.fi team is committed to keeping its protocol non-custodial and decentralized, guaranteeing that stakers have complete control over their assets. Furthermore, the protocol adheres to a sustainable revenue model, avoiding short-term schemes and focusing on long-term planning

All of these design choices are aligned with Ethereum ethos, as Ether.fi has a set of principles that guide the protocol, emphasizing ethics, long-term sustainability, and accountability for any missteps.

Here are some of the highlights of the Ether.fi protocol:

-

Total Value Locked (TVL): ~$3.17 billion, with ~957,000 ETH staked.

-

Staking Rewards: Base APR of 3.21%, with additional rewards generated in the form of Ether.fi and Eigenlayer points.

-

Governance: ETHFI token holders will be able to vote on proposals, effectively deciding the future development of the Ether.fi protocol.

-

Innovation: Ether.fi's collaboration with EigenLayer introduces a novel restaking mechanism, further enhancing rewards for stakers.

Why weETH?

weETH is designed for seamless integration into DeFi, powered by Ether.fi's partnerships across a wide array of DeFi protocols. The token is already highly versatile for DeFi applications.

Davos Protocol will introduce an additional use case by allowing weETH to serve as collateral for minting our stablecoin. This will provide users with a superior option for accessing a broader range of yield farming opportunities.

[1] - weETH and eETH details (Source)

[1] - weETH and eETH details (Source)

Integrating weETH on Davos Protocol

Integrating weETH with Davos Protocol marks a significant achievement for the platform, showcasing its ability to attract and leverage some of the most sought-after assets in the current landscape.

This milestone boosts our protocol's appeal while also solidifying its position as a pioneering force in the LRTFi sector. By venturing into LRTs, Davos Protocol is unlocking new avenues for yield generation, further diversifying the options available to its users. EtherFi is the leading restaking protocol in terms of TVL, thus we expect it to bring substantial value to the ecosystem, ensuring the platform's offerings are both competitive and in line with market demands.

Moreover, this move will allow for the collateralization of an asset class like weETH which preserve underlying rewards while providing additional yield through stablecoin usage . By prioritizing assets like weETH, which are expected to appreciate more rapidly than other reward-bearing tokens, Davos Protocol is setting the stage for a significant and swift improvement in its users' Health Ratios.

How to Mint DUSD with weETH

To mint DUSD using weETH, users must first engage with the Ether.Fi platform, where they can stake their ETH to mint weETH). After obtaining weETH, users should navigate to the Davos.xyz platform.

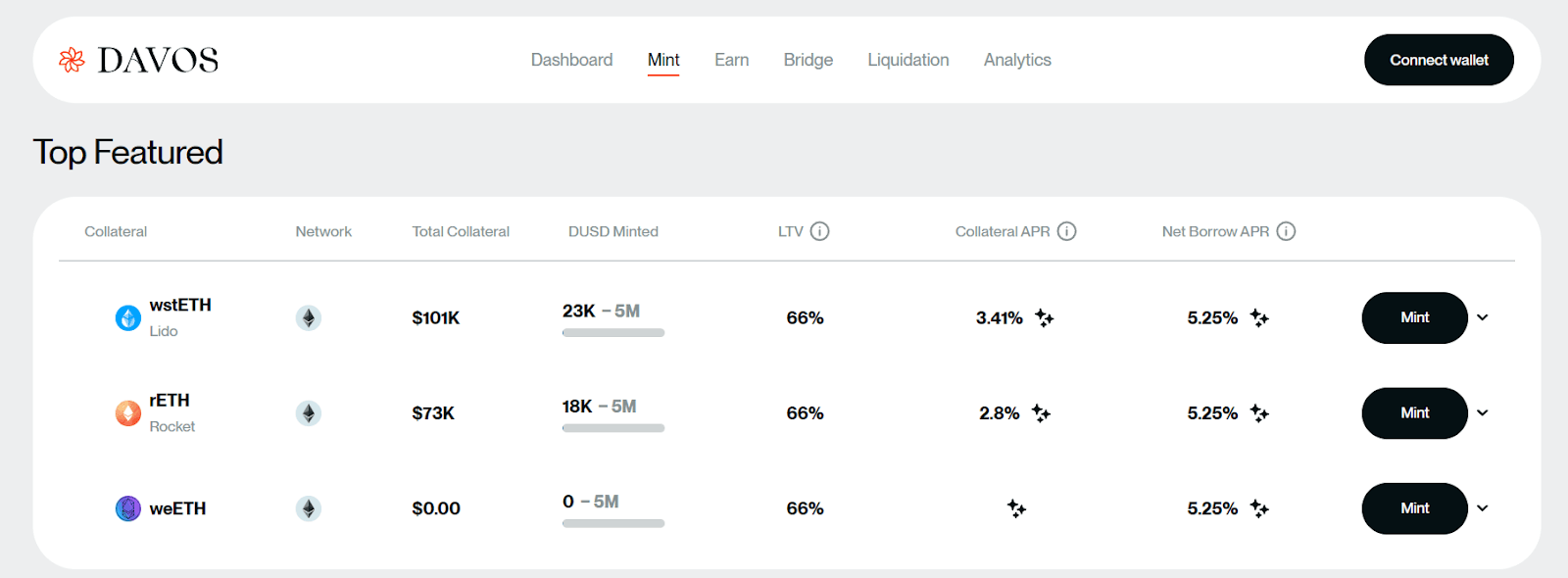

Here, weETH serves as collateral, enabling the minting of DUSD. This procedure is designed to be straightforward for users, with Davos Protocol currently offering a 66% Loan-to-Value (LTV) ratio for this specific asset. The LTV ratio is a critical factor to consider as it determines the amount of DUSD you can mint based on the value of the weETH collateral.

[2] - weETH as a top features minting Option on Davos Dashboard (Source)

[2] - weETH as a top features minting Option on Davos Dashboard (Source)

Once users have minted DUSD, a realm of yield farming opportunities unfolds across various chains integrated with the Davos Protocol. Leveraging our platform's no-fee bridge, users can transfer their DUSD across different chains without any additional fees.

Moreover, users can opt to stake DUSD with Davos Protocol and mint sDUSD, Davos Protocol omnichain savings rate token. In doing so, users collectively receive back 5% of the platform fees.

Leveraging these opportunities can significantly amplify the potential returns from DeFi activities. Nonetheless, we would like to remind you that overleveraging may lead to permanent losses, thus act carefully and always do your own research on the topic.

Unlock the Full Potential of Liquid Restaking with Davos

We are excited to offer our community the enhanced benefits of weETH collateralization. By committing ourselves to constant innovation, and gradually expanding the supported collateral of DUSD, our goal is to bring the best of DeFi to the masses.

Visit Davos today to explore the new integration and unlock the full potential of your Ethereum investments.