How to Use DAVOS Boosted Vaults

Boosted vaults are a popular tool in decentralized finance, allowing users to contribute funds to a pool and earn returns based on trading fees and price movements. Davos offers a couple boosted vaults that provide attractive opportunities for individuals interested in participating in decentralized finance.

In this guide, we'll explore how to use Davos boosted vaults and discuss the benefits of participating in these platforms. We'll also look at some of the risks involved and provide tips on how to make informed investment decisions.

Gamma Boosted Vaults

Gamma boosted vaults offer users the opportunity to actively provide liquidity to QuickSwap v3 pairs with the aim of generating attractive returns. By participating in these boosted vaults, individuals can contribute their funds to a diverse range of QuickSwap pairs that are actively managed. This means that the vaults are designed to continuously monitor and adjust the liquidity allocation across various pairs based on market conditions, aiming to optimize returns.

With gamma boosted vaults, users can tap into the potential of QuickSwap, a decentralized exchange built on the Polygon network, which allows for efficient and fast token swaps. By providing liquidity to QuickSwap v3 pairs, individuals can become liquidity providers and earn returns based on trading fees and potential price movements of the tokens in the pairs. The boosted vaults aim to maximize these returns by actively managing the liquidity allocation, adjusting it dynamically to capitalize on market opportunities.

Uniswap & Boosted Vault

To use boosted vaults with the USDC and DUSD liquidity pair, you can follow these steps:

- Ensure you have USDC and DUSD tokens: Before utilizing the boosted vaults, you need to have both USDC and DUSD tokens in your wallet or on the Polygon network. You can acquire DUSD on the protocol’s web app.

- Access the pool: Navigate to the Uniswap boosted vault to start the process.

- Connect your wallet: Connect your digital wallet that holds your USDC and DUSD tokens to the platform. This step is necessary to interact with the vaults and perform transactions.

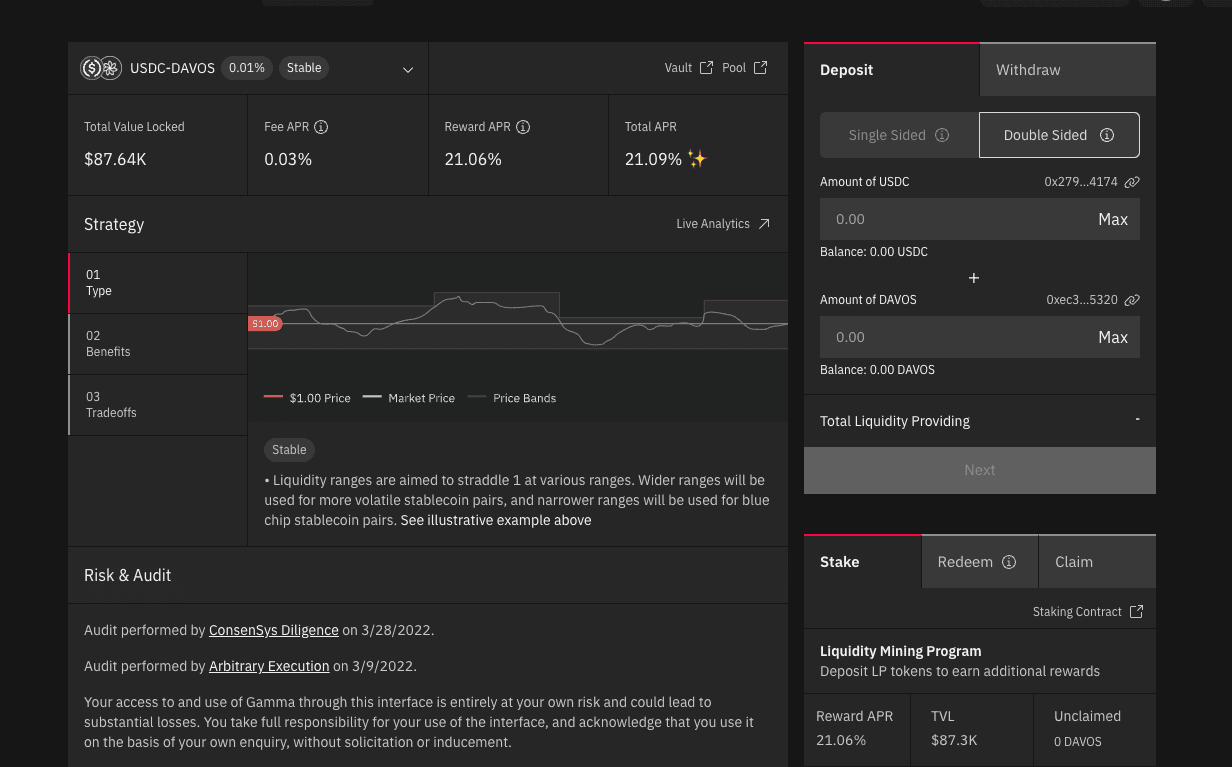

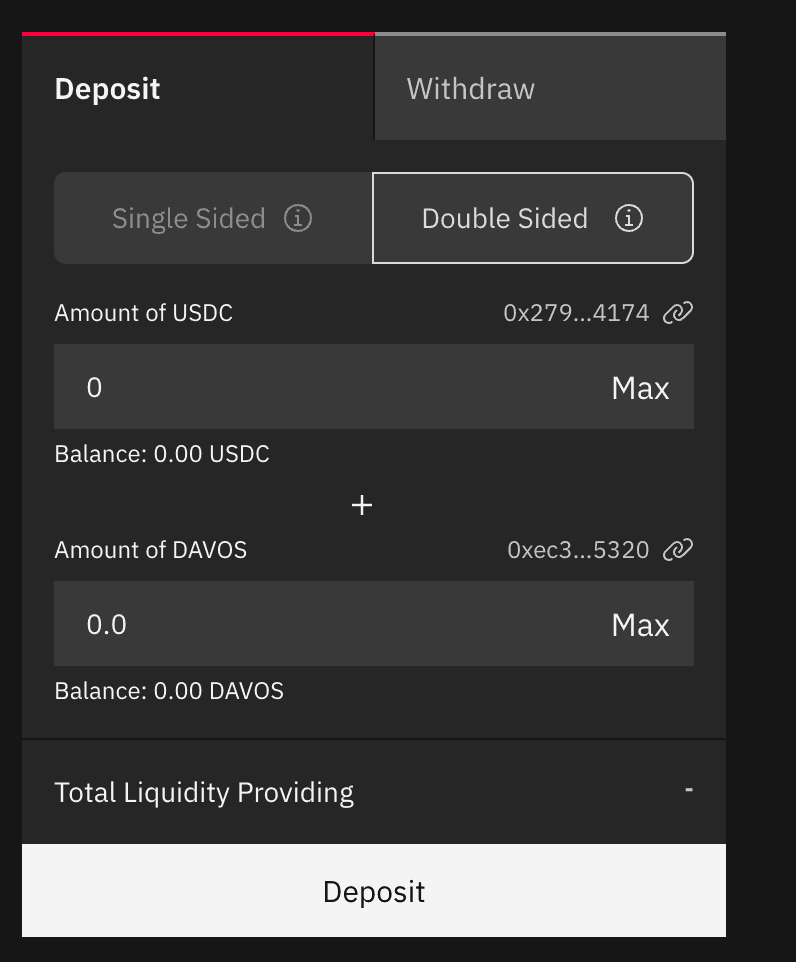

- Deposit your funds: Follow the instructions provided on the platform to deposit your USDC and DUSD tokens into the boosted vaults. (see the image below) You will select the amount of USDC and DUSD to deposit.

1. Receive your USDC-DUSD LP token as a result of depositing both parts of the pair.

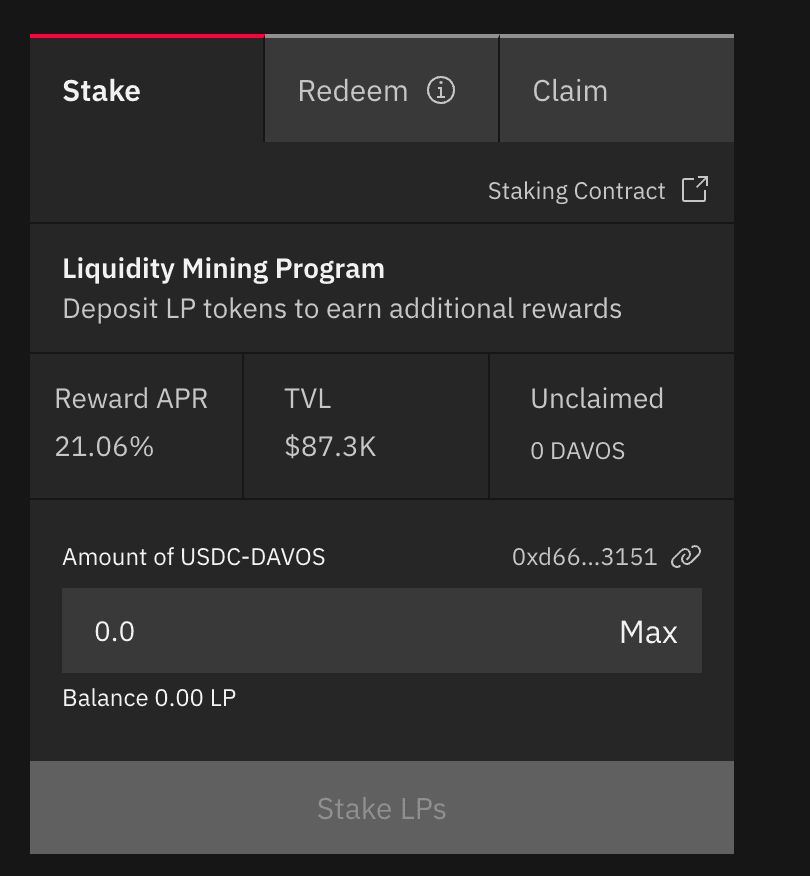

2. Stake your LP: If you want to receive even more rewards you can stake your DUSD-USDC LP to earn an APR of 20%+. You will earn rewards in the form of DUSD tokens.

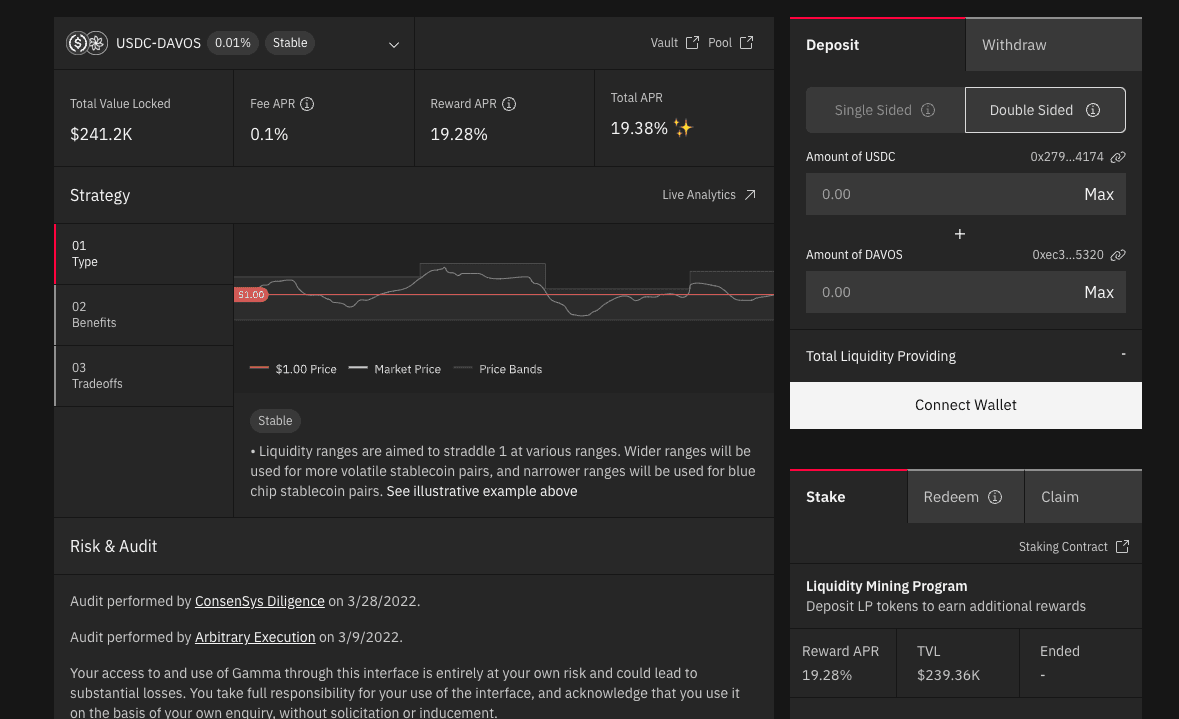

Quickswap Boosted Vault

To use the Quickswap boosted vault, the process is similar to Uniswap. You'll start by ensuring you have both USDC and DUSD tokens in your wallet or on the Polygon network. Then, navigate to the Quickswap boosted vault, connect your wallet, and deposit your funds following the instructions in the previous section.

When deciding which boosted vault to invest in, you can choose based on the APY and TVL of each platform. It's important to note that the boosted vaults are actively managed and will adjust the liquidity allocation across various pairs based on market conditions to optimize returns. As with any investment, it's crucial to do your research and understand the risks involved before investing your funds. By following the steps outlined in this guide and exercising caution, you can potentially earn attractive returns with boosted vaults that are much higher than just staking your DUSD or putting your tokens into a liquidity pool that isn’t boosted.

Conclusion

In conclusion, boosted vaults are a valuable tool for individuals looking to participate in decentralized finance and earn attractive returns. However, it's essential to understand the risks involved and exercise caution before investing your funds. By following the steps outlined above and doing thorough research, you can make informed decisions and potentially maximize your returns with boosted vaults on platforms like Gamma, Uniswap, and Quickswap. As with any investment activity, it's always recommended to seek personalized advice from financial professionals or experts in DeFi to ensure you're making the best decisions based on your specific financial situation and objectives.