The Rise of BTCfi: How Bitcoin is Entering the DeFi Space

Bitcoin has long been hailed as the “digital gold” of the cryptocurrency world—a store of value, a hedge against inflation, and a safe haven in the turbulent seas of the real world, aka: traditional finance (TradFi). However, a new trend is emerging, one that will propel BTC beyond its static role and into the dynamic, fast-paced world of decentralized finance (DeFi). Welcome to BTCfi: a growing movement where Bitcoin, generally known as a passive asset, is being actively used within DeFi ecosystems to generate yields, provide liquidity, and open up new financial services.

As BTCfi gains traction, Davos Protocol is rising to the occasion, embracing the evolution by integrating new Bitcoin-related assets such as Avalon wBTC on BitLayer and stCORE from CoreDAO. This marks a pivotal moment in Davos’s journey and the broader DeFi landscape, where Bitcoin is no longer just a store of value, as Satoshi Nakamoto planned, but a productive asset capable of driving the next generation of financial innovations through BTCfi.

What is BTCfi?

BTCfi represents the growing use of the Bitcoin network within decentralized finance protocols. Traditionally, Bitcoin has been viewed primarily as a long-term investment, held for its potential value appreciation or as a hedge against inflation. However, a new narrative is taking shape—one where Bitcoin is not just held but actively deployed in DeFi protocols (BTCfi) to earn yields and participate in various financial activities.

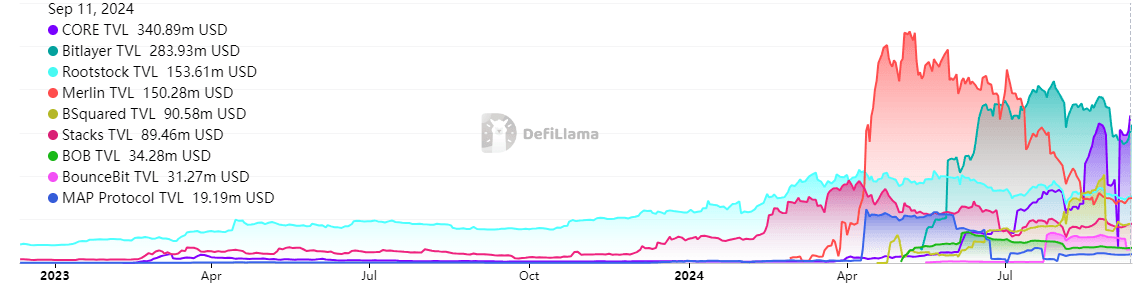

This shift (BTCfi) is more than a passing trend in the cryptocurrency market; it’s underpinned by significant growth and interest. Since 2023, the total value locked (TVL) in BTCfi protocols has surged by over 20 times. Institutional interest is also expanding, with major financial institutions seeking ways to leverage their Bitcoin holdings in DeFi.

_Growth of BTC Sidechains and Layer 2 Networks since 2023 _

_Growth of BTC Sidechains and Layer 2 Networks since 2023 _

The growth of DeFi initially flourished within the Ethereum ecosystem, benefiting from its advanced technology infrastructure, smart contract capabilities, and diverse decentralized applications. However, Ethereum faces limitations in scaling and liquidity, creating obstacles to innovation. Emerging Layer 2 networks and protocols often struggle with security and scalability challenges, resorting to high-risk or unsustainable models to drive adoption, which can undermine the ecosystem’s stability.

BTCfi aims to bridge these gaps by combining Bitcoin’s blockchain vast liquidity and secure proof-of-work foundation with the innovation and flexibility of DeFi platforms on Ethereum. Bitcoin’s immense market capitalization can serve as a deep liquidity pool that can increase security and support network growth for emerging ecosystems. This strategic integration brings together Ethereum’s advanced technology and Bitcoin’s unmatched liquidity and security, forging a more robust, balanced, and secure landscape named: BTCfi.

How Has Bitcoin Evolved: From Store of Value to Active Asset?

1. Security as a Service:

Bitcoin’s vast market capitalization is now being leveraged to improve the security of emerging protocols in Defi. By incorporating BTC-backed assets, new BTCfi platforms can benefit from Bitcoin’s proven reputation and proof-of-work security, laying a solid foundation that builds user trust network stability.

2. Yield Farming:

BTC holders can now generate yield by deploying their holdings in decentralized applications (dApps). Instead of remaining idle, with BTCfi users can be put to use in ecosystems through lending, borrowing, or restaking. This approach allows Bitcoin holders to earn rewards, access liquidity, or participate in decentralized exchange & yield farming, all while retaining their Bitcoin exposure.

3. Collateralization in DeFi:

BTC-backed assets are increasingly serving as a form of collateral in decentralized protocols. Using entering the BTCfi space are now able to borrow stablecoins or other assets against their Bitcoin derivatives, unlocking liquidity without selling their BTC. This approach maintains exposure to Bitcoin’s price movements while enabling participation in various BTCfi activities, such as trading, lending, or yield farming.

Davos Protocol’s Entry into BTCfi

Davos Protocol is making a strategic move to embrace the BTCfi movement by integrating new BTC-related assets as collateral. This initiative marks Davos’s entry into a rapidly expanding trend and positions the protocol as a pioneer in bringing Bitcoin’s potential into the DeFi space.

To align with the BTCfi trend, Davos is introducing two new collateral types: Avalon wBTC (aBitwBTC) and stCORE. Avalon wBTC, a wrapped Bitcoin derivative on the BitLayer network, and stCORE, the liquid staking token from CoreDAO, allow Bitcoin holders to mint DUSD and engage in yield-generating activities on the platform.

- Avalon wBTC: This is a derivative token representing wBTC on the BitLayer network, designed to maintain Bitcoin’s value while benefiting from BitLayer’s scalability and cost-efficiency. By using Avalon wBTC as collateral, Bitcoin holders can mint DUSD and explore various BTCfi opportunities through Davos.

- stCORE: A liquid staking token from CoreDAO, which is an EVM-compatible Layer 2 network powered by Bitcoin. stCORE represents staked CORE tokens, offering both the continuous accumulation of staking rewards and the flexibility to participate in BTCfi strategies.

With these integrations, Davos is not just riding the BTCfi wave but helping to shape it. And this is just the beginning, Davos plans to continue expanding its BTC-backed offerings by integrating more BItcoin derivatives in the near future. Stay tuned for exciting updates on new collateral types that will further boost your ability to leverage Bitcoin in BTCfi!

The Future of BTCfi & its Impact on the Financial World

As BTCfi continues to grow, new use cases like decentralized derivatives trading and BTC-based digital assets will emerge, and Davos is ready to be at the forefront of this evolution.

Davos is committed to pioneering new opportunities by integrating BTC derivatives and Bitcoin-based Defi Integrations (BTCfi), enabling Bitcoin holders with secure and yield-generating options. We aim to be the gateway for Bitcoin holders looking to enter BTCfi, offering diverse strategies to op returns.

Join us on this journey! Explore Davos Protocol today to leverage your Bitcoin holdings and unlock new yield-generating opportunities. Be part of the next wave of innovation in decentralized finance and help shape the future of BTCfi with us.