Davos 101: Basic Guide to the Davos Web App

The Davos Protocol is a DeFi platform that offers users a stable asset, DUSD, which is pegged to the US dollar. One of its main features is the ability to generate yield through stable asset staking rewards. This article explores how the Davos Protocol generates yield through staking, liquidity pools, and boosted vaults.

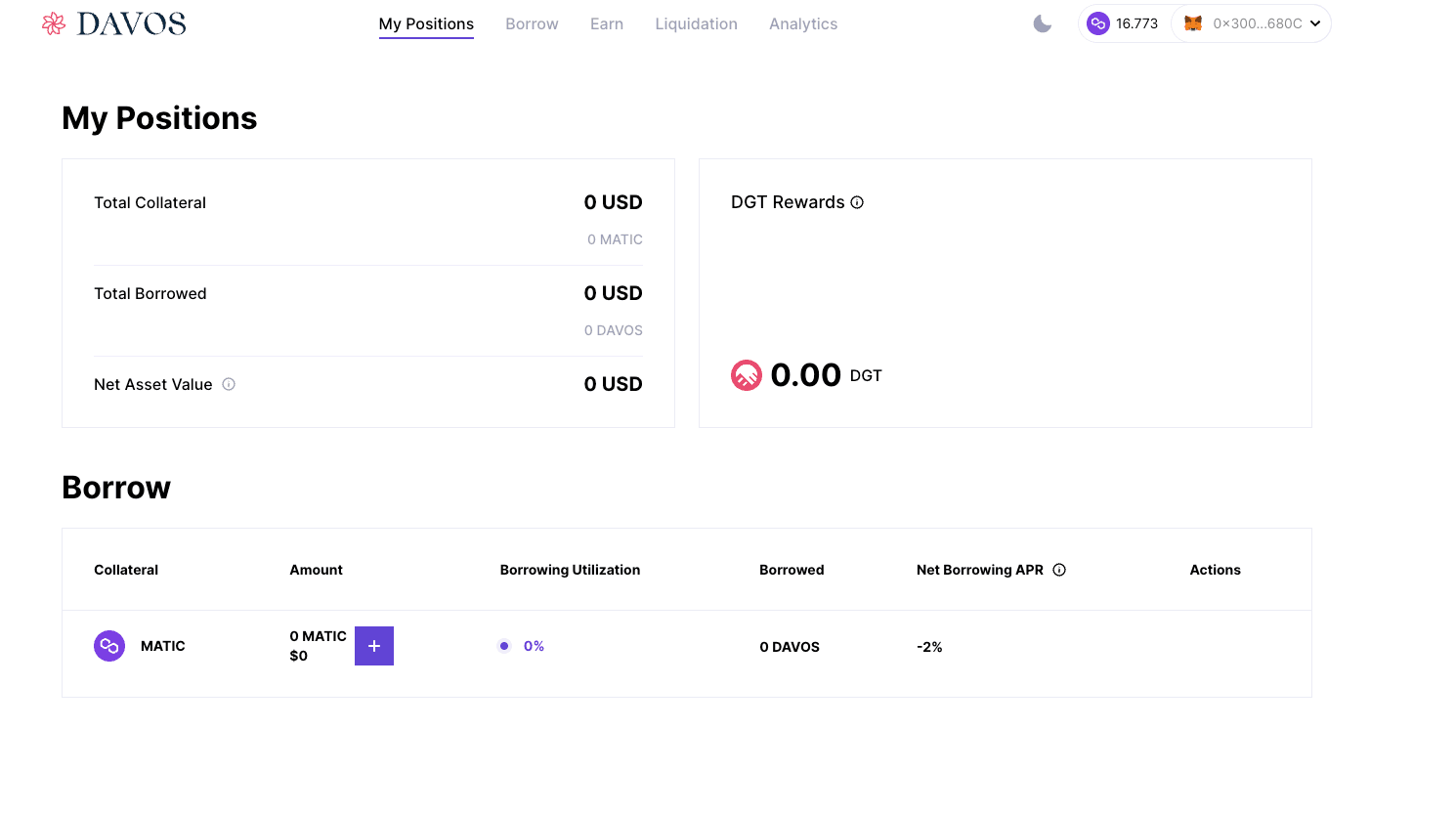

Your Dashboard

Your Dashboard is an important tool that provides you with a comprehensive overview of your DUSD and MATIC holdings. This information is crucial for you to make informed decisions about your investments and to stay up-to-date on your financial status.

In addition to displaying the amount of DUSD that you own and how much MATIC you have collateralized, the Dashboard also provides you with valuable insights into your borrowing activity. For instance, you can easily see the amount of DUSD that you have borrowed against your collateral, as well as your current borrowing interest rate.

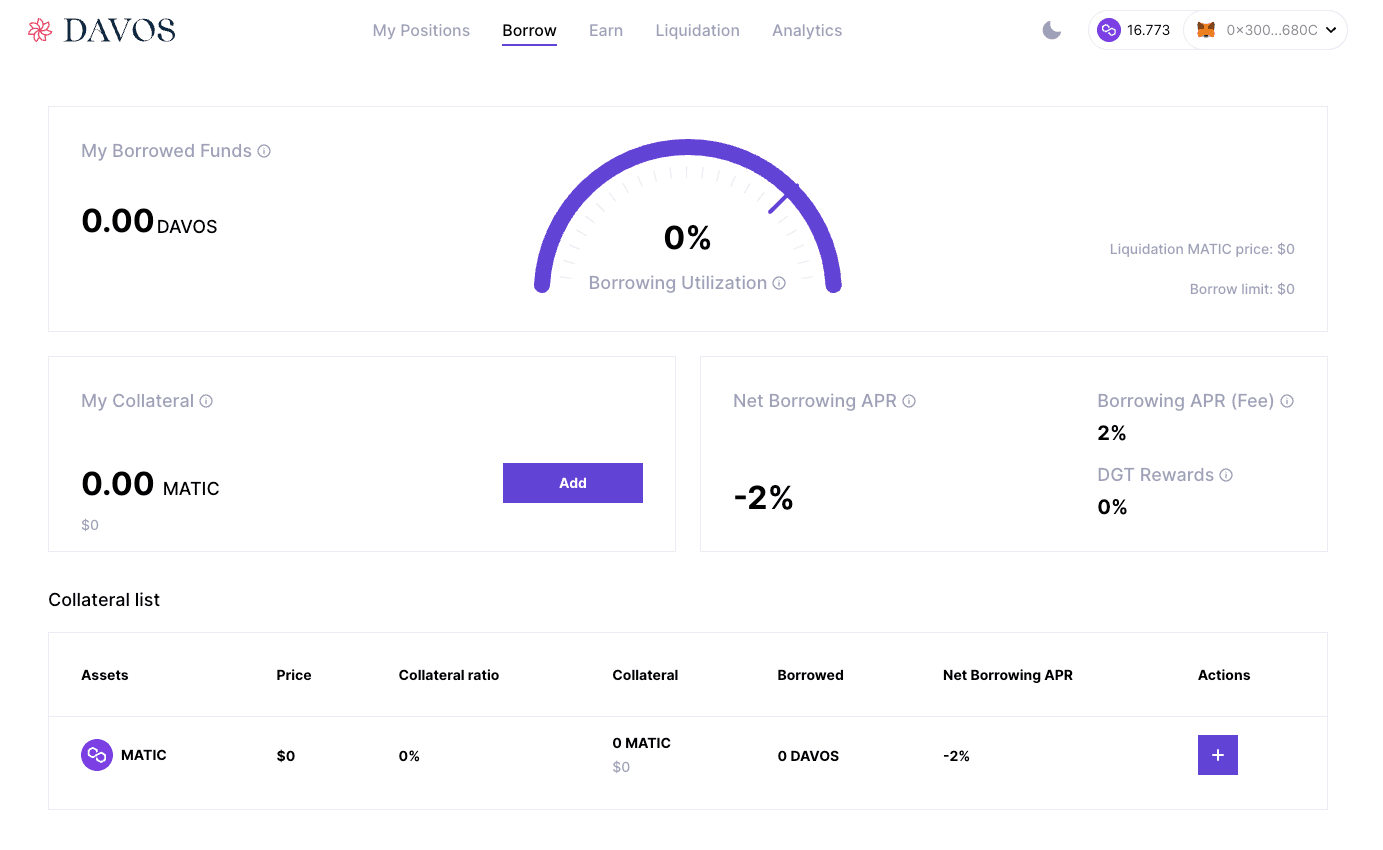

Borrowing Dashboard

The Davos web app offers a lot of possibilities to its users, and one of them is the ability to borrow DUSD by depositing MATIC as collateral. This borrowing feature is designed to help users access additional DUSD tokens while maintaining their MATIC holdings.

To access this feature, users can visit the Borrowing Dashboard, which is available on the web app. On the Borrowing Dashboard, users can see the amount of collateral they have deposited and how much of that collateral they have withdrawn as DUSD. This dashboard provides users with an easy-to-use interface to manage their borrowing activities.

With this feature, users can deposit a specific amount of MATIC and borrow an equivalent amount of DUSD tokens. Borrowers can then use their DUSD tokens for trading, yield farming, or any other purpose. The amount of DUSD that can be borrowed depends on the amount of collateral deposited and the borrowing interest rate.

Overall, the ability to borrow DUSD with MATIC collateral on the Davos web app is a useful feature for users who want to access more DUSD tokens while maintaining their MATIC holdings. It provides a convenient and secure way for users to borrow tokens and manage their borrowing activities.

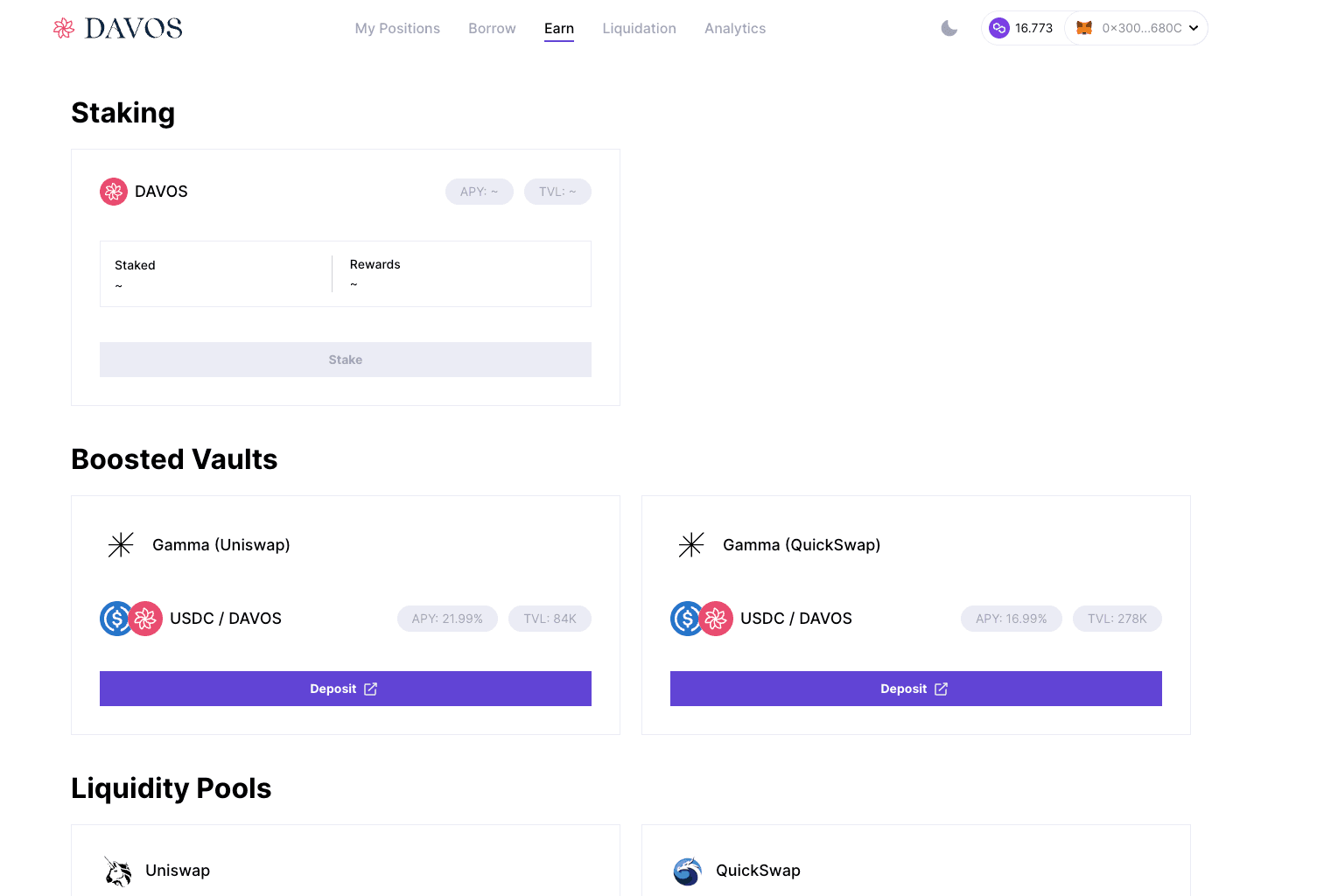

Earning Real Yield with DUSD

If you're a DUSD holder on the Davos Protocol, you can earn real yield by navigating to the "Earn" section of the navigation bar on the web app. Here, you'll find a variety of options available to you, each with its own unique yield-earning potential.

One of the simplest ways to earn yield with DUSD is by staking your tokens. By staking your DUSD, you're essentially locking them up in the protocol and helping to secure the network. In return for your contributions, you'll receive a yield of 7-9%. This yield is generated through a combination of staking rewards and borrowing interest paid to the protocol. As users over-collateralize their positions into DUSD, a percentage of the collateral gets converted into ankrMATIC reward-bearing tokens. Over time, the protocol's reserve of ankrMATIC accumulates in value, and the rewards get converted back into DUSD. A proportion of the rewards is then granted to stakers and liquidity providers at the rate of 7-9% APY.

Another way to earn yield with DUSD is by depositing your tokens into a liquidity pool. Liquidity pools are a type of DeFi protocol that allows users to pool their funds together in order to provide liquidity for a specific asset. In return for providing liquidity, users receive a yield in the form of LP tokens. These tokens represent your share of the liquidity pool and can be redeemed for the underlying assets at any time. By depositing DUSD and USDC into a liquidity pool, you can earn a yield on your tokens without having to actively manage them.

For users looking to earn even higher yields, the Davos Protocol offers boosted vaults. Boosted vaults are a type of DeFi protocol that use complex yield-earning strategies, such as lending and borrowing on various DeFi platforms, to generate higher returns for users. By depositing your DUSD into a boosted vault, you can earn a much higher yield than you would through staking or liquidity pools. However, because these strategies are more complex, they also carry a higher level of risk.

Overall, the "Earn" section of the Davos web app provides a variety of options for DUSD holders looking to earn yield on their tokens. Whether you prefer a simple staking strategy or a more complex boosted vault, there's an option available to suit your needs. So why not explore the "Earn" section today and start earning real yield with your DUSD on the Davos Protocol?

Conclusion

In conclusion, the Davos Protocol offers a variety of options for users looking to earn yield on their DUSD tokens. With simple staking strategies, liquidity pools, and complex boosted vaults, there's an option available to suit everyone's needs. In addition, the Borrowing and Dashboard features provide users with convenient tools to manage their borrowing activities and stay up-to-date on their financial status. Overall, the Davos Protocol is a promising DeFi platform that offers users a stable asset and real yield-earning opportunities.