Davos Protocol debuts as the first CDP Protocol on Mode Network

The Davos Protocol is more than just another actor in the Defi (Decentralized Finance) space. Davos began as a fork of the well-known MakerDAO and has evolved to address the intrinsic yield deficiencies of stablecoins, intending to transform the sector by providing stability, scalability, and inclusivity.

With that goal in mind, we are excited to expand our protocol through a new integration with Mode Network, an Ethereum Layer 2 solution.

Mode Network was created to optimize the blockchain ecosystem, bringing scalability and efficiency through faster and cheaper transactions. Working alongside Optimism on the development of the Superchain, Mode's primary objective is to foster the development of top-tier dApps (decentralized applications).

This integration of the Davos Protocol into Mode is a landmark development, marking the first instance of a CDP Protocol on the network.

Integration of Davos into Mode

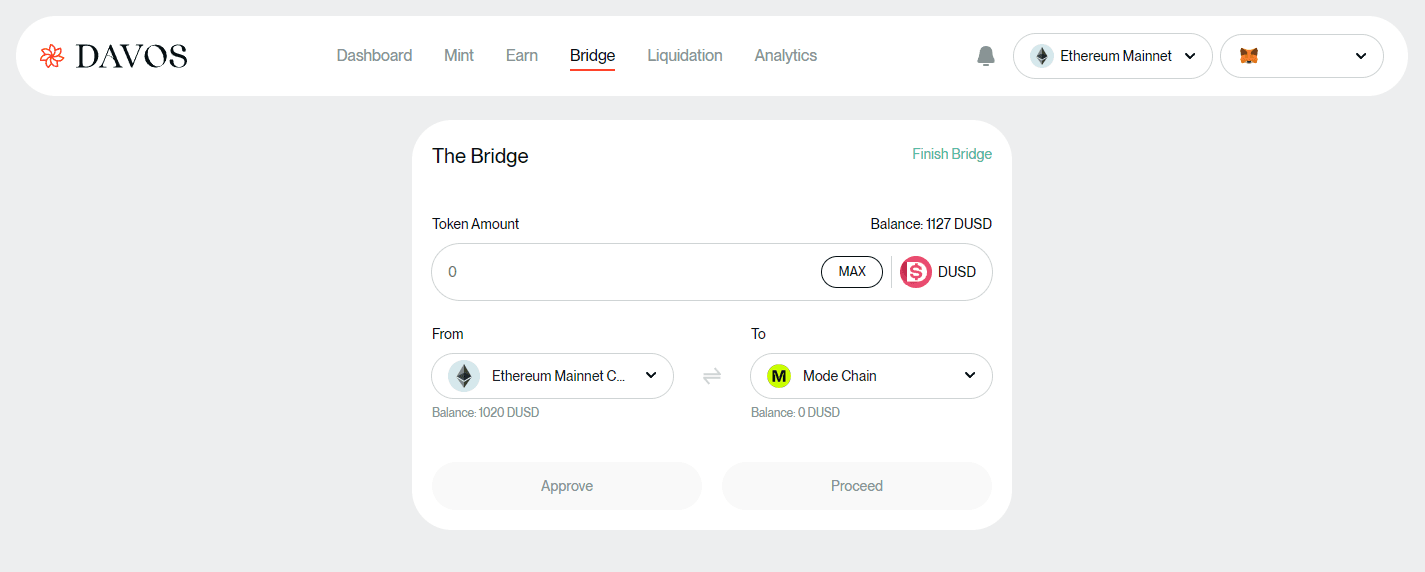

This latest integration not only enables users to bridge DUSD, Davos’s Stablecoin, into Mode Network but also allows users to mint DUSD natively on Mode utilizing Renzo’s ezETH as collateral.

Moving forward, the integration will grow further, allowing the collateralization of additional rewards-bearing assets to mint DUSD, considerably boosting its adaptability. Stay tuned for more exciting details on future integrations that will increase the financial possibilities within Mode

[1] - Davos Bridge Dashboard, Bridging DUSD to Mode (Source)

[1] - Davos Bridge Dashboard, Bridging DUSD to Mode (Source)

DUSD's design allows it to maintain a stable value while being used across different blockchain networks, including Ethereum, BNB Chain, Polygon, Optimism, and Arbitrum. Soon, the DUSD Savings Rate (sDUSD) will also be utilized seamlessly within Mode network, fostering an expanded cross-chain operational capacity.

Onboarding Mode Network: Full List of Benefits

Better Liquidity

By enabling users to bridge DUSD to Mode Network, we are opening doors for greater liquidity. Furthermore, the option to mint DUSD natively on Mode with Renzo's ezETH as collateral, as well as the planned future inclusion of other reward-bearing stablecoins, will further boost liquidity. Mode network will benefit from added liquidity while our protocol will be introduced to a large new community.

The integration of leading blockchains, such as Mode, is expected to attract new users, thus fostering the adoption of DUSD. Subsequently, this will also bring more attention to the DUSD Savings Rate (sDUSD), our go-to staking solution designed to provide users with a predictable Savings Rate.

Improved Stability

The integration with Mode has the potential to make DUSD even more stable. This is achieved by broadening the range of assets used as collateral, such as the recent addition of Renzo’s ezETH on Mode.

As we onboard new assets as collateral, users will eventually be able to mint DUSD natively on any blockchain, increasing the simplicity and versatility of DUSD. Additionally, having access to a bridge allows users to move DUSD between networks whenever necessary.

Better Financial Instrument

The inclusion of features such as Flash Mint and sDUSD will empower Mode users with sophisticated financial tools and extra-yield farming opportunities through upcoming liquidity pools on Leading Decentralized Exchanges (DEXs). These features not only let users leverage their assets more effectively but also allow them to capitalize on their underlying collateral.

This creates opportunities for higher returns and the exploration of complex Defi investment strategies, thereby improving both financial growth and stability.

Cross-Chain Utility

The omnichain capability of DUSD stands out by allowing transactions across multiple networks, which can be especially beneficial in a fragmented blockchain environment. This utility makes DUSD an excellent tool for bridging assets between different networks, enhancing the interconnectedness of the Mode ecosystem with other blockchains.

User Empowerment and Ecosystem Growth

Davos Protocol addresses common DeFi challenges such as market volatility and liquidity constraints. Its dynamic feedback loop system encourages borrowing and stimulates ecosystem growth by redistributing borrowing revenues back into the system, thus enhancing user incentives and financial empowerment.

Building a Cohesive Blockchain Ecosystem with Mode

Davos Protocol offers a robust solution to the Mode ecosystem, providing tools that foster user empowerment and financial growth. By exploring the integration of Davos and utilizing DUSD, users within Mode can expect a more fluid, efficient, and profitable DeFi experience.

For more information on how Davos can boost your DeFi investment strategies, visit Davos today!