Davos Protocol Reimagined: DeFi's Future is Here

Since its inception in 2015, Ethereum has been the house of DeFi, which has been on an exhilarating ride of exponential growth! From the pioneer versions of decentralized exchanges or the first iterations of collateralized debt positions in 2017, the space has been growing at a tremendous pace.

As the sector expands, new concepts flood users’ minds daily, making it challenging to stay ahead. TradFi principles are being reimagined in DeFi, bringing more overwhelming procedures and mechanics even to the most dedicated enthusiasts.

Davos Protocol aims to rise above the noise by offering a straightforward and intuitive platform dedicated to all things DeFi, simplifying the space through a unique stablecoin approach, innovative yield generation, and an unarbitrary monetary policy in its upcoming V2.

The goal is simple: bridge the gap between TradFi and DeFi, cutting through the clutter to enhance user experience and understanding.

Davos Protocol: Reimagining DeFi

Davos Protocol is a Collateralized Debt Position (CDP) platform that enables the seamless minting of DUSD, an omnichain stablecoin. Since our conceptual iteration in late 2022 and our first public steps in March 2023, we have embarked on a journey to deliver the best of DeFi in an accessible and meaningful way to all our users.

Acknowledging past mistakes made by various DeFi protocols and adhering to the best industry practices, Davos Protocol has unveiled the power of decentralized stablecoins—a critical tool in our industry—built upon a structured and robust infrastructure.

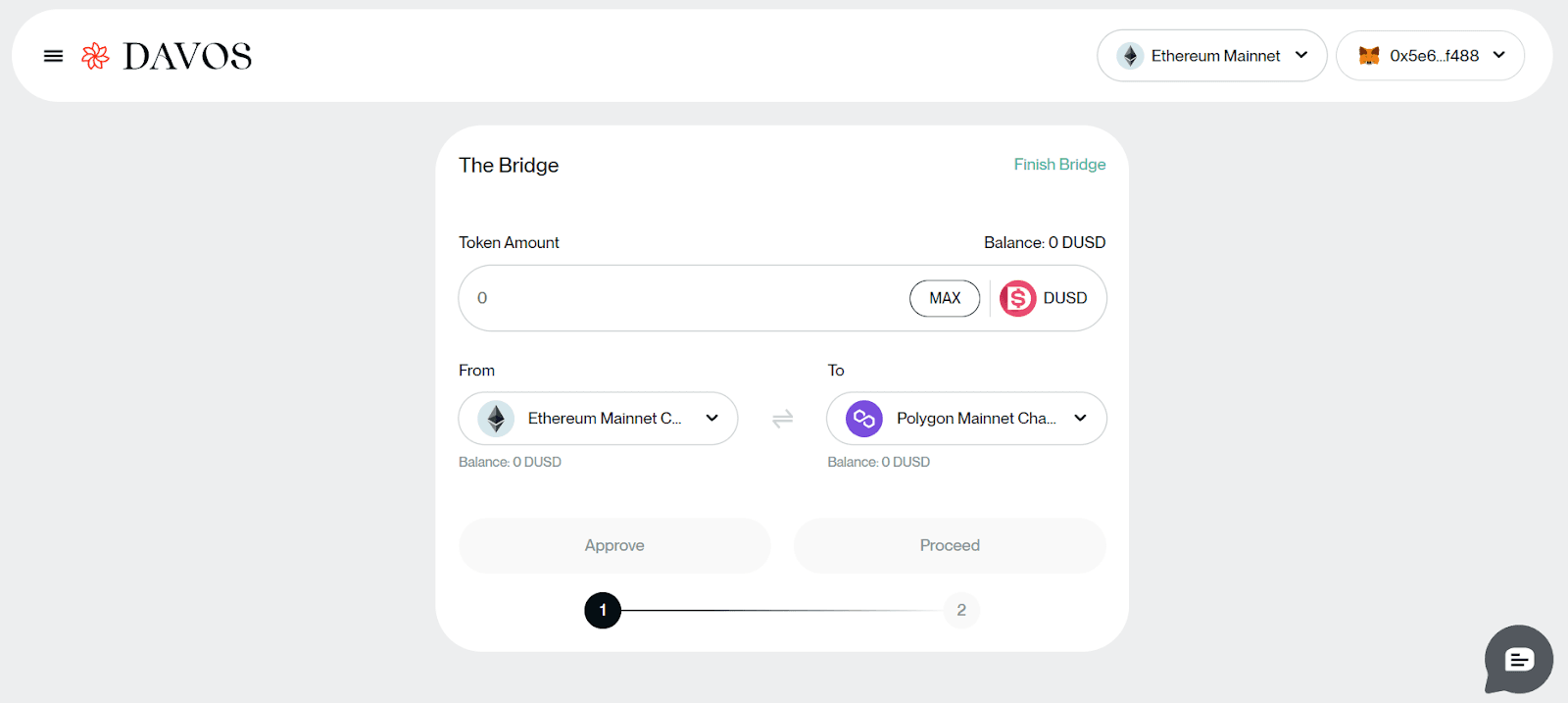

DUSD is not just an ordinary stablecoin; it is an essential tool for navigating the ever-expanding DeFi landscape. Recognizing the significance of Layer 2 solutions, Davos Protocol has implemented its mechanics in an omnichain manner, ensuring that our users can capitalize on every opportunity.

The DUSD Savings Rate token (sDUSD) stands as a testament to our efforts to be present wherever the best opportunities lie. DeFi won't be built on a single chain, and neither will Davos Protocol.

From the introduction of DUSD to the launch of our very own bridge facilitating free movement between the most promising EVM chains, to the implementation of an omnichain savings rate, our efforts have a singular purpose: to offer our users the best solution to capitalize on their reward-bearing tokens.

[1] - The Davos Bridge Dashboard (Source)

[1] - The Davos Bridge Dashboard (Source)

Our Mission and Values

At the core of Davos Protocol's evolution is our commitment to tackling the intrinsic yield challenges of stablecoins, all while empowering users with advanced financial mechanisms. A cornerstone of our CDP strategy is maintaining an over-collateralization ratio of 150%, ensuring the stablecoins we issue are consistently backed by assets of significantly higher value.

The strategy of using reward-bearing assets as collaterals provides a vital defense against market volatility since users’ assets will be accruing value during their collateralization, which helps them maintain a healthier LTV. Thus, this approach is not just a superficial policy aimed at making attractive claims but is informed by hard-earned lessons from previous decentralized stablecoin models.

Our mission revolves around enabling users to extract more value from their assets. To accomplish this, we steadfastly adhere to our core values of Security, Transparency, Reliability, and Decentralization.

We've learned from the past that stable assets should avoid relying solely on algorithmic stability without the backing of collateralized assets or fiat reserves. Experience with earlier DeFi protocols has also taught us the importance of understanding the source of yield. In cases where the source of yield is unclear, it's likely that you are the yield for others.

This understanding has guided us to develop a protocol-native yield, anchored on the borrowing rates, which is far more dependable than one reliant on external factors or artificial cases through high inflation token incentives.

While the requirement for users to collateralize their assets to mint DUSD and the application of borrowing rates on loans may make Davos Protocol less attractive, it enables us to guarantee that the yield generated is genuine and sustainable, akin to TradFi systems.

By basing DUSD borrowing mechanics on the best of both DeFi and TradFi practices, we ensure long-term stability and competitive opportunities, steering clear of unrealistic promises.

Fulfilling one of our primary principles, security, Davos' smart contracts have undergone multiple audits by leading blockchain auditing firms, including Quantstamp, SlowMist, and Veridise, reinforcing our commitment to safety and trust.

The Davos Journey

The early initiatives of Davos Protocol were guided by recognizing the importance of reward-bearing tokens. Starting with the integration of Liquid Staking Tokens (LSTs), acknowledged as a market-leading solution, Davos Protocol embraced the future of finance.

But the journey didn't stop with LSTs. Davos Protocol has since expanded its offerings to include reward-bearing stablecoins. These assets, with their inherent stability thanks to a linkage to other stablecoins, enable Davos Protocol to offer more attractive loan-to-value ratios. Such empowers users to leverage their assets more effectively, unlocking new avenues for yield farming while maintaining all the underlying rewards associated with the collateral they’re using.

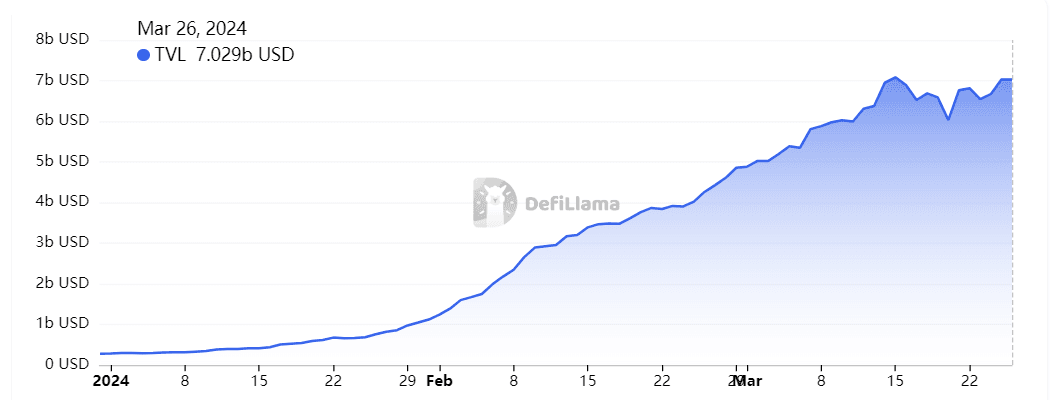

The horizon for Davos Protocol includes the exciting domain of Liquid Restaking Tokens (LRTs), a sector witnessing a dramatic rise with a total value locked (TVL) soaring to $7 billion. Recognizing the potential of LRTs, Davos Protocol is poised to provide solutions that allow users to mint DUSD by using their LRTs as collateral.

[2] - Liquid Restaking TVL growth - March 2024 (Source)

[2] - Liquid Restaking TVL growth - March 2024 (Source)

Davos Protocol remains vigilant, ready to adapt to emerging reward-bearing assets that promise reliable, long-term yields. This proactive stance ensures that Davos Protocol not only overcomes the challenges associated with the limited utility of reward-bearing tokens but also capitalizes on these opportunities to boost liquidity, yield generation, and cross-chain capabilities for its users.

This forward-thinking approach underlines Davos Protocol's commitment to providing innovative financial mechanisms, enhancing the user experience by offering more value and stability in the rapidly evolving DeFi landscape.

Joining a New Era for Stablecoins

The Davos Protocol invites users to explore its innovative stablecoin minting and yield generation platform.

By participating in Davos, users can contribute to and benefit from a system designed for stability, scalability, and predictability. The future of DeFi starts with Davos, where every stakeholder has the opportunity to redefine the potential of their assets in a decentralized financial ecosystem.