Davos Protocol's Approach to LRTs: A New Horizon in DeFi

Blending the reliability of traditional finance with the innovative aspects of DeFi, our ultimate aim is to enable users to maximize their financial growth.

We have reimagined collateralized debt positions (CDPs) and addressed yield deficiencies in stablecoins, becoming the best solution for stability, scalability, and inclusivity in the DeFi industry.

However, the work doesn’t stop here. To continue to be at the forefront, we need to innovate and keep up with the latest trends. That is why we are excited to be working on integrating Liquid Restaking Tokens (LRTs) into the Davos protocol.

Liquid Staking Tokens (LSTs) were a significant breakthrough in the DeFi sector, emerging as a fundamental component of our protocol. Their integration within Collateralized Debt Positions (CDP) and lending protocols, flourishing the segment, expanding the opportunities for users to extract greater value from their assets.

Building on this, we are now turning our attention to the pioneering realm of Liquid Restaking.

What are Liquid Restaking Tokens (LRTs)?

The advent of the liquid restaking model by EigenLayer has been a game-changer for the DeFi ecosystem. This model has allowed for the repurposing of staked ETH and ETH LSTs to bolster another tier of smart contracts, known as Actively Validated Services (AVSs).

EigenLayer's innovation introduced a cryptoeconomic base that not only increased rewards for users but also eased one of the more challenging obstacles for developers: creating their trust networks for developing distributed systems such as bridges, sequencers, and Data Availability layers.

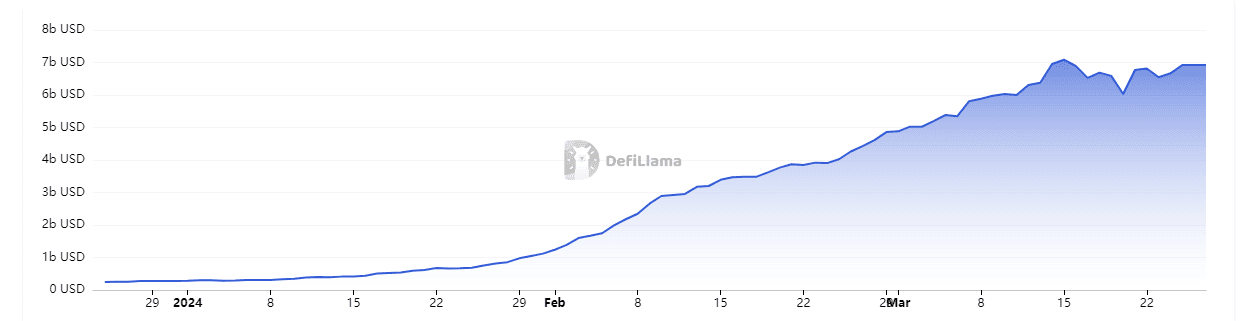

Due to its significant utility, the Total Value Locked (TVL) for restaking surged each time EigenLayer enabled users to restake their assets. Despite this, investors faced inherent capital inefficiencies that limited the full potential use of their capital, a barrier that persisted until the emergence of the first LRT protocols.

LRTs represent the next evolutionary step in the world of staking. That is made evident by the exponential growth registered over the past months, with the TVL in LRT protocols reaching an impressive $7.6 billion.

[1] - Liquid Restaking TVL in 2024 (Source)

[1] - Liquid Restaking TVL in 2024 (Source)

Through restaking, investors can help secure networks and dApps while simultaneously being able to engage with several DeFi protocols, thus contributing to the composability of the DeFi sector.

From an economic standpoint, LRTs could present a more attractive option than LSTs due to their potential for higher yields. With the anticipated rise in the volume of staked ETH, it's logical to expect a decrease in staking rewards. This trend makes restaking a more compelling choice for users seeking to maximize their investment returns.

LRTs vs LSTs

While both LSTs and LRTs add liquidity to the DeFi ecosystem, they have different purposes.

LSTs address the issue of locked liquidity in traditional staking, allowing users to receive tokens that represent their staked assets, enabling them to trade or use these assets without breaking staking contracts.

LRTs take this concept further by allowing the staked assets, represented by LSTs or natively staked ETH, to be restaked. When users deposit their natively staked ETH or ETH LSTs, they receive LRTs, which can then be used in various applications.

Unlike LSTs, LRTs support the development of dApps, allowing for additional validations, and are highly interoperable, meaning they can be seamlessly integrated across different blockchains.

The Role of LRTs in Davos

Recognizing the growing interest and potential of LRTs, our team is working around the clock to introduce these assets into the Davos protocol.

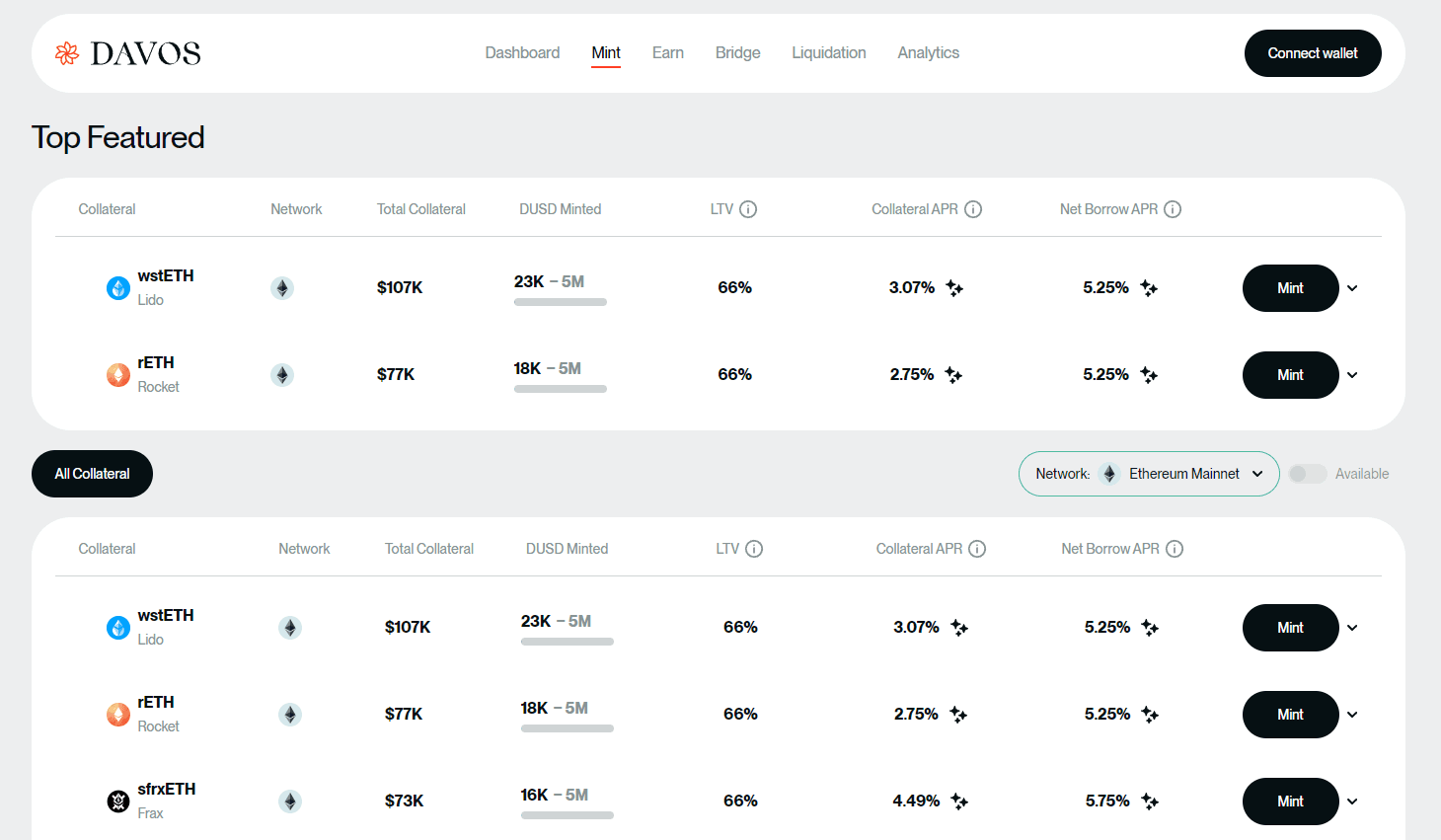

The goal is to allow our users to mint DUSD, our omnichain stablecoin, by using LRTs as collateral. In doing so, we will further ensure the stability and liquidity of our services.

[1] - Davos DUSD Minting Dashboard (Source)

[1] - Davos DUSD Minting Dashboard (Source)

Furthermore, the integration of LRTs into the Davos Protocol enables the compounding of yield rewards, positioning us to offer some of the most competitive APY rates in the market. By allowing users to deposit assets with higher yield potential, Davos Protocol anticipates a quicker and more substantial improvement in users' Health Ratio since the value of users’ assets is expected to increase at a faster rate compared to their Liquid Staking Token (LST) counterparts.

However, rewards invariably come with their own set of risks. LRTs represent a riskier class of assets. To mint an LRT, users must accept an increased level of risk, exposing their stakes to the performance of two distinct sets of validators. Additionally, the potential for restaking various LSTs means LRTs carry a doubled risk of depegging — affecting not just the underlying asset but the LRT itself.

Within the LRT category, it is possible to distinguish between less risky options, like native ETH restaking, where the risk is limited to validator performance, and more risky alternatives, such as basket-based LRTs.

In response to these risks, Davos Protocol will implement minting caps on LRTs accepted as collateral. These caps are determined based on comprehensive risk assessments conducted on these assets. By setting these minting limits, the protocol aims to shield itself from contagion risks that may arise from a downturn in any of the collateral pools, thereby safeguarding the entire protocol from extensive exposure.

Davos Protocol is dedicated to performing in-depth due diligence on all LRTs it considers for inclusion, striving to minimize the risk of any adverse effects on our protocol.

Looking Ahead

The trajectory of LRTs within Davos Protocol suggests an ambitious roadmap ahead. With potential integrations and expansions on the horizon, the emphasis on LRTs signals a commitment to pioneering within the DeFi sector.

This forward-looking approach promises to enrich the Davos ecosystem and contribute to the broader blockchain community's growth.

As Davos continues to explore the potential of LRTs, it invites users, developers, and enthusiasts alike to join in shaping the future of finance. Mint DUSD and explore additional yield farming opportunities with Davos Protocol and join this transformative financial journey.