Davos Protocol's Journey to DUSD Stability and Yield Innovations

TL;DR:

- The Davos Protocol stands out in the Defi Landscape for its resilience and forward-thinking solutions.

- DUSD serves as a reliable omnichain stablecoin solution, underpinned by a 150% over-collateralization model to maintain its peg.

- Liquid Staking Tokens (LSTs) enable users to borrow against their staked assets without losing staking rewards, offering a way to "double-dip" for increased yield potential.

- The Davos Governance Token (DGT) empowers holders with voting rights on protocol decisions, promoting a community-driven governance model.

- The recently introduced DUSD Savings Rate token (sDUSD) enables our stablecoin holders to accrue a portion of the earnings generated by the Davos Protocol.

Emerging during turbulent times in DeFi

Davos Protocol emerged during one of the most volatile periods in DeFi's history. Standing as a paragon of innovation and resilience, the protocol has made significant strides over the past year and a half by continually refining and expanding its offerings to cater to the diverse needs of its users.

At the heart of these advancements are its foundational elements: the DUSD stablecoin, Liquid Staking Tokens (LSTs), and the future integration of Liquid Restaking Tokens (LRTs).

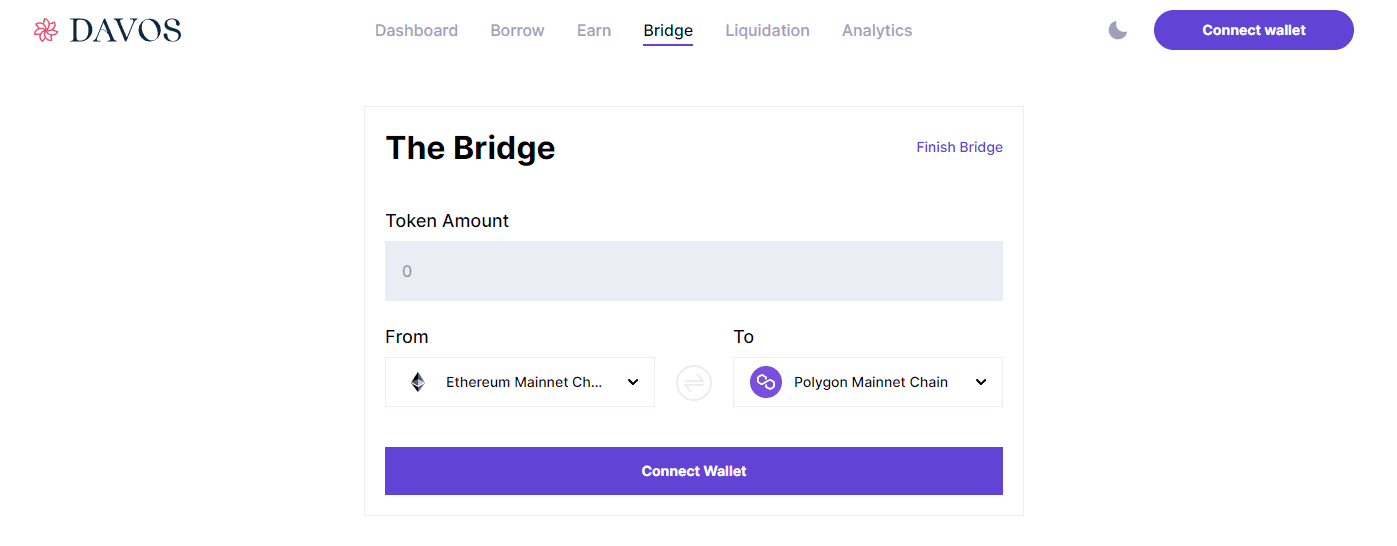

Furthermore, Davos has introduced reward-bearing stablecoins, developed a unique bridge for omnichain DUSD functionality, and established a multichain DUSD Savings Rate (sDUSD).

[1] - Davos Bridge Dashboard (Source)

[1] - Davos Bridge Dashboard (Source)

With a veModel soon to be deployed that integrates borrowing and liquidity gauges with veNFTs, thus setting a new benchmark for governance and incentives within the DeFi sector.

DUSD Stablecoin: Merging the world of TradFi and DeFi

Davos aims to bridge the gap between traditional finance (TradFi) and decentralized finance (DeFi), as the rise in interest rates in TradFi has negatively affected stablecoin returns in the blockchain sector. The Davos Protocol seeks to reconcile these two worlds, offering DeFi a stable and predictable reference rate for stablecoins.

The native stablecoin of Davos Protocol offers a novel approach by leveraging LSTs and other reward-bearing assets to provide a robust omnichain solution. This innovation simplifies the staking and farming processes, enabling users to compound their yields with minimal risk.

Our users can benefit from the recently launched sDUSD, an ERC-20 token that distributes rewards to DUSD holders. These rewards are generated from the interest paid by users looking to borrow DUSD. A share of this interest revenue is allocated to sDUSD holders, enhancing the DUSD Savings Rate.

The protocol maintains or exceeds the Federal Reserve's borrowing interest rate, ensuring a competitive savings rate for DUSD across multiple blockchain networks.

DUSD’s Groundbreaking Price Stability Mechanism

Davos ensures the resilience of DUSD through a 150% over-collateralization model, safeguarding it against the volatile swings that are all too common in the DeFi space.

Additionally, by employing reward-bearing stablecoins from several lending protocols, Davos ensures a high Loan-To-Value (LTV) ratio that can go as high as 93% for DUSD’s issuance. It also enables traders to stabilize DUSD’s peg by exploring arbitrage opportunities. Thanks to our native bridge, these arbitrage opportunities are easily exploited across several chains.

In practice, this means that whenever DUSD’s value fluctuates, traders who turn a profit from the price discrepancy are actually contributing to the stability of our stablecoin.

Finally, our users can also benefit from the recently launched sDUSD, an ERC-20 token that accrues yield and shares a fraction of the Davos Protocol's profits with its owners.

Liquid Staking Tokens (LSTs): Amplifying Yield Potential

LSTs represent a significant breakthrough in the Davos Protocol ecosystem. These tokens symbolize staked assets along with their accruing rewards, serving as a versatile form of collateral.

Users can engage in borrowing activities against their staked assets without forfeiting the benefits of staking rewards, thereby "double-dipping" into both staking and DeFi yield opportunities. The protocol facilitates borrowing across multiple chains, with varying minimum borrowing amounts to cater to a wide user base, thus enhancing accessibility and flexibility in yield generation.

Liquid Restaking Tokens (LRTs): The Next Frontier in Yield Maximization

The future introduction of LRTs marks a new era in the Davos Protocol's journey, pushing the boundaries of DeFi composability.

LRTs allow users to re-stake their already staked assets on platforms like EigenLayer, facilitating participation in securing other networks or services while retaining liquidity. This innovation enables users to "triple-dip," leveraging their assets across multiple layers of yield generation without sacrificing the liquidity provided by the borrowed stablecoin.