How Davos Plans to Mitigate the Effects of Inflation

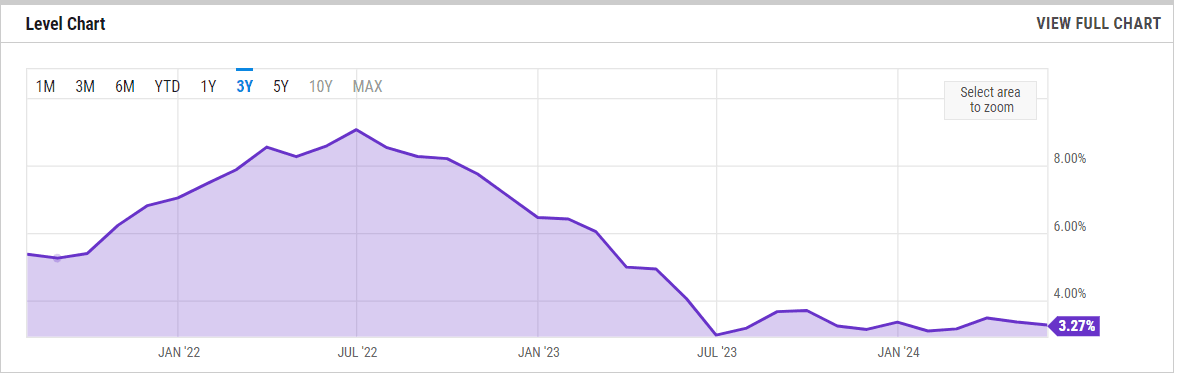

The inflation rate has finally stabilized after the hyperinflationary period of 2022-2023, which saw peaks as high as 9.06%. However, the lingering effects of this tumultuous period continue to impact the economy, underscoring the critical need for innovative financial solutions.

(Source)

(Source)

Traditional methods often fall short in addressing these challenges, necessitating the emergence of new strategies and novel financial instruments. That is why we believe DeFi and Davos are essential tools to combat inflation.

In this blog post, we’ll delve deep into how Davos Protocol’s dynamic borrowing and monetary policy aims to mitigate the effects of inflation, delivering predictable and sustainable returns.

Inflation Challenges

A Rampant Problem

In our previous post: Understanding Inflation and How DeFi Plans to Solve It - we explored the fundamental nature of inflation, its causes, and its widespread impact on purchasing power, savings, and the cost of living.

We also discussed how decentralized finance (DeFi) offers promising solutions to combat inflation, particularly through the use of reward-bearing stablecoins, yield farming, and other decentralized protocols.

Importance of Sustainable Solutions

In light of these challenges, it is essential for DeFi protocols to offer reliable and sustainable financial solutions. The volatility of traditional markets requires novel approaches to ensure users can protect and grow their wealth despite inflationary pressures.

Introduction to Davos Protocol’s Approach

Davos Protocol is committed to addressing inflation through innovative monetary policies. By leveraging borrowing rates and sustainable savings mechanisms, Davos provides users with tools to safeguard their assets against inflation.

Here are the tools that Davos has to offer:

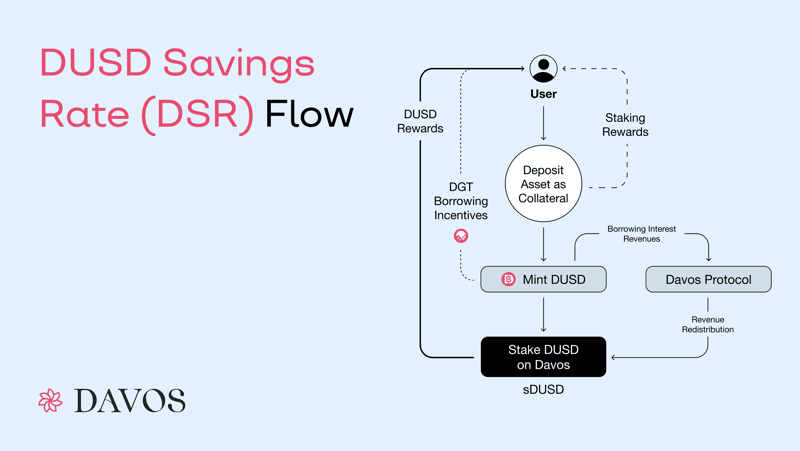

The DUSD Savings Rate - sDUSD

sDUSD is a financial instrument that enables DUSD holders to participate in a decentralized savings scheme across different blockchain networks, effectively earning interest on their DUSD holdings. This is what it offers:

- Predictability: This savings rate offers increased predictability for users, ensuring they can rely on stable returns despite fluctuating market conditions.

- Sustainability: By engineering a robust savings mechanism, Davos ensures users receive reliable returns even in volatile interest rate environments, fostering long-term financial stability.

(Source)

(Source)

To learn more about how the DUSD Savings Rate works, check out our blog about it:

-> What is DUSD and sDUSD: A Beginner’s Guide

An Omnichain Savings Rate

By allowing assets to be bridged between multiple chains, Davos ensures that its users can maximize their strategy regardless of the network. Here’s what a multichain sDUSD experience has to offer:

- Omnichain Functionality: This sDUSD omnichain functionality allows users to engage with these tokens on various blockchain platforms, increasing their utility. This functionality is crucial for providing diversified and resilient savings options.

- Accessibility and Reach: Davos Protocol aims to expand the appeal and reach of its Omnichain Savings Rate, making it accessible to users across various chains. This inclusivity enhances the protocol’s utility and attractiveness.

Dynamic Borrowing Rates Explained

- Risk-Adjusted Rates: Borrowing rates of DUSD are adjusted based on the risk profile of the collateral used. Higher-risk collateral incurs higher borrowing costs, while lower-risk collateral benefits from reduced rates. This balance ensures fair and realistic borrowing costs.

- Examples of Risk Profiles: For instance, using volatile crypto assets as collateral might result in higher borrowing rates compared to more stable assets like established stablecoins or high-liquidity cryptocurrencies.

Real-World Benefits

Inflation Mitigation

Davos Protocol’s mechanisms help users protect their wealth against inflation. By offering dynamic borrowing rates and sustainable savings options, users can hedge against the devaluation of money and preserve purchasing power.

Stable Returns

In volatile markets like Defi, the importance of stable and predictable returns cannot be overstated. Davos Protocol’s approach ensures users can achieve financial stability and growth, regardless of market fluctuations.

Building a Deflationary and Sustainable Financial Future

Inflation is an enduring economic challenge, but with innovative solutions like those offered by Davos Protocol, users can effectively mitigate its effects. The dynamic borrowing rates and all-weather savings mechanisms provide a robust framework for protecting and growing wealth in an inflationary environment.

To learn more about how Davos Protocol can help you manage inflation and secure your financial future:

Visit Davos Protocol and explore our comprehensive range of inflation-proof solutions.