Stable vs. Volatile Assets: Which One is Better for Yield Farming?

Since yield farming has become a popular trend, the question that arises for many investors is whether stable or volatile assets are more lucrative for yield farming. In this article, we will explore the pros and cons of using stable and volatile assets for yield farming and provide examples of leading articles in the DeFi space to support our analysis.

Yield Farming Stable Assets

Stable assets are widely used in yield farming because they provide stability and a consistent rate of return. One of the main advantages of stable assets is that they provide a more predictable yield, making them a safer option for investors who prefer a more conservative approach.

Additionally, stable assets are widely accepted across various DeFi protocols, making them a highly liquid option for yield farming. Stablecoins like USDT, USDC, and DAI are commonly used for yield farming and provide a stable yield, regardless of market fluctuations. Recent market statistics show that the total stablecoins in circulation just reached $51 Billion, which shows the ubiquity of stablecoins in circulations and in liquidity pools.

Yield Farming Volatile Assets

On the other hand, volatile assets like Bitcoin or Ethereum can provide higher returns but come with greater risk. Volatile assets have higher price volatility, making them more prone to impermanent loss. Yield farming with volatile assets can provide higher yields, but investors must be willing to accept the higher risk that comes with it.

Another advantage of using volatile assets is that they can provide exposure to other cryptocurrencies that may have greater upside potential. Yield farming with volatile assets can provide an opportunity for investors to earn high returns while also gaining exposure to other cryptocurrencies that have greater potential for appreciation. On the flip, the losses can be that much greater and your investing decisions must be based on your risk tolerance.

Yield Strategies Within Stable Asset Protocols

One thing to understand about DeFi is that just about every protocol has some yield-earning mechanism built-in and not all are made equal. Some protocols use shady and rug-pull(y) tactics while others are committed to the long-term integrity of their protocol and rely solely on reliable, real yield. When you’re doing your own research (DYOR) you should always fully understand where the yield is coming from.

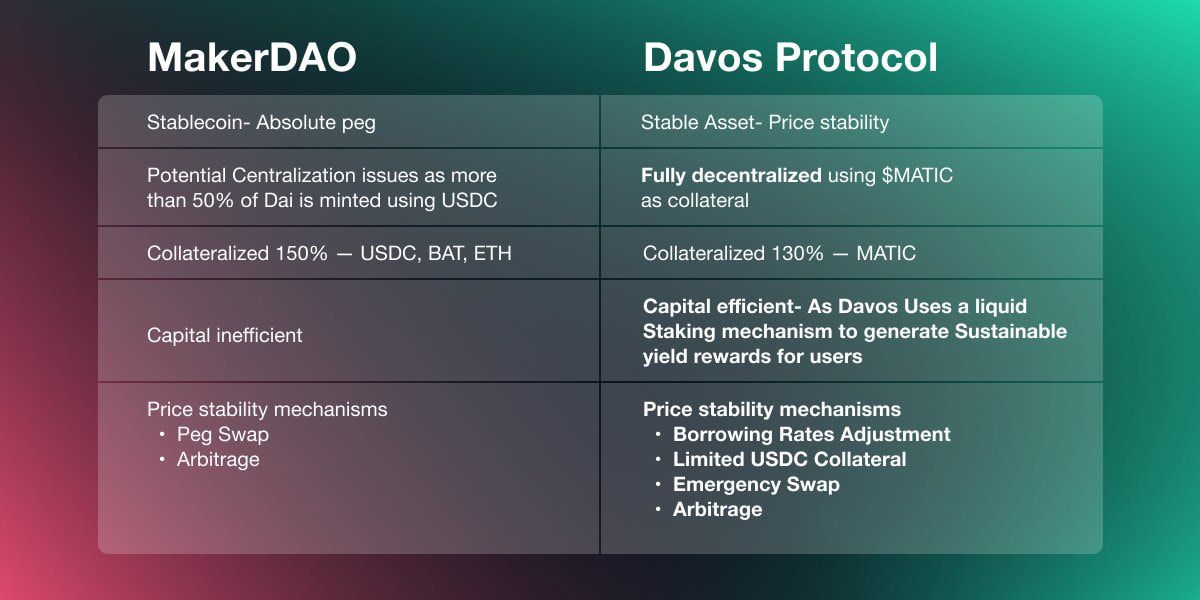

That being said, Davos protocol is committed to ensuring stable, real yield. We are fully transparent as to how the yield is generated (through liquid staking mechanisms in our reserve).

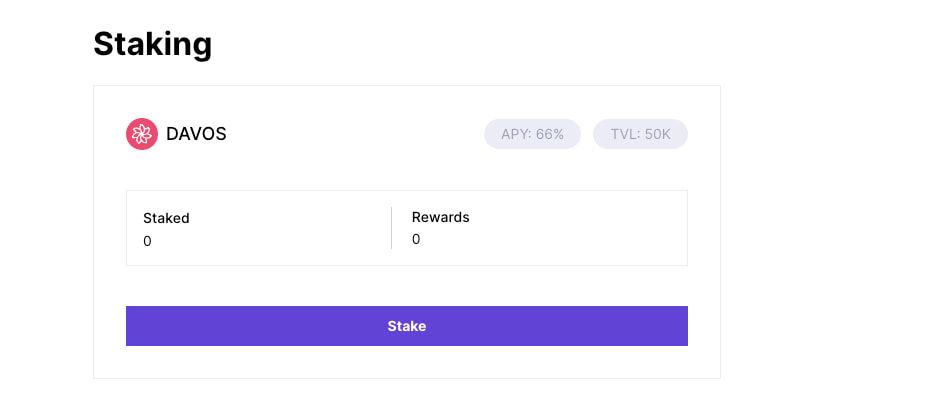

Davos also has full transparency on how they yield is payed out to users (through staking DUSD in the web app).

Davos Stable Asset Liquidity Pools

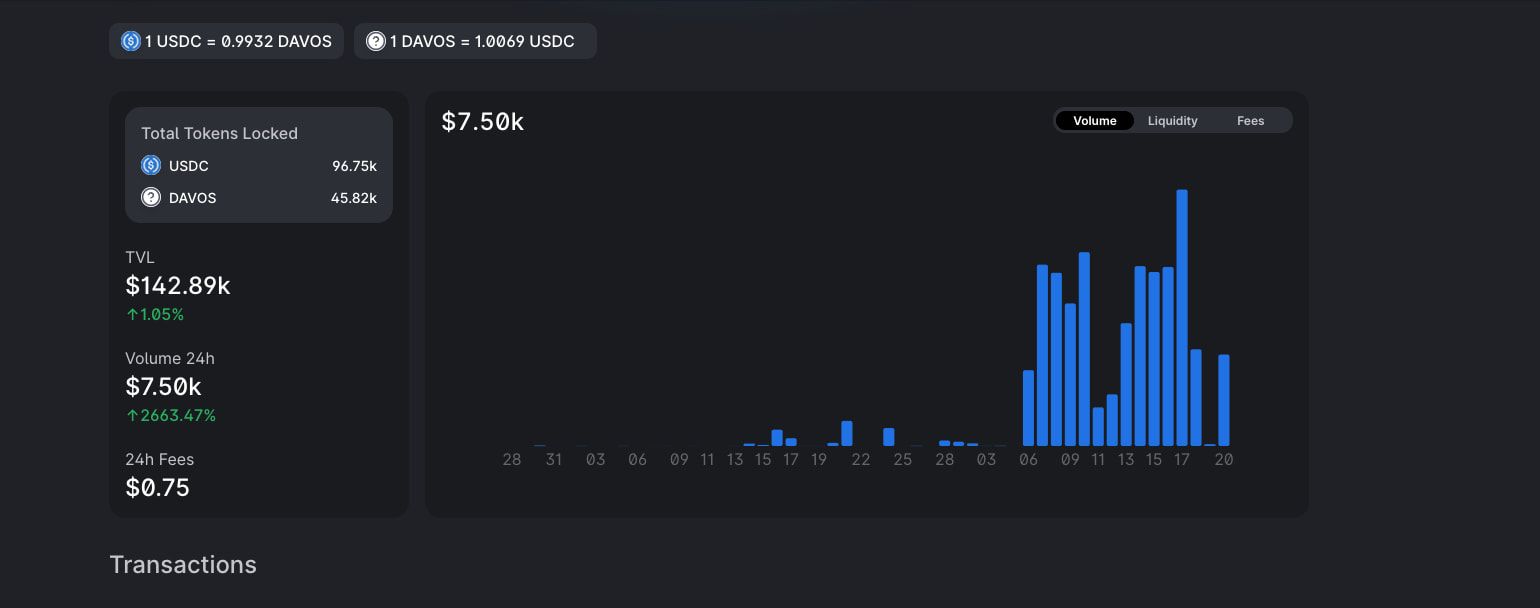

Many of the liquidity pools that consist of two stablecoins have low yield, but the upside is that it’s reliable. For example, the DUSD/USDC has $140k liquidity and is a reliable source of yield.

If you’re looking to diversify your more risky strategies, then a stable asset liquidity pool may be a good way to balance out the risk portfolio.

Conclusion

In conclusion, both stable and volatile assets have their pros and cons when it comes to yield farming. Stable assets provide stability, consistency, and liquidity, making them a safer option for investors who prefer a more conservative approach. Meanwhile, volatile assets offer higher yields and exposure to other cryptocurrencies but come with greater risk.

Investors should carefully consider their risk tolerance and investment goals when deciding which assets to use for yield farming. Furthermore, doing your own research and understanding the token that you’re farming and where the yield is coming from is of utmost importance.

Ultimately, the decision of whether to use stable or volatile assets for yield farming will depend on an individual's investment strategy and objectives. As the DeFi space continues to evolve, it's important for investors to stay informed about the latest developments and trends in order to make informed decisions about their investments.