How Davos Ensures Sustainable Growth in Defi

In the rapidly evolving space of Decentralized Finance, achieving sustainable protocol growth presents a real challenge.

The volatile and cyclical nature of crypto markets is unforgiving. Bear markets present a real test for projects, as countless projects get weeded out due to unsustainable tokenomics, faulty business models, and other factors.

Ensuring long-term viability without compromising on agility and user benefits is a puzzle many protocols struggle with. Davos addresses these issues with an innovative model known as the Dynamic Feedback Loop.

Challenges of Sustainable Growth in DeFi

Sustainable growth in DeFi is thwarted by factors such as high volatility, uncertain regulatory landscapes, and the scalability of the blockchain networks.

Protocols must adapt quickly, managing risks while maximizing returns for users. The importance of finding robust solutions cannot be overstated; without them, DeFi projects risk losing relevance and failing to capitalize on market opportunities.

For better insight on Sustainability Challenges in Defi, check our most recent blogpost:

-> The Challenge of Sustainable Growth in Defi

Dynamic Feedback Loop Explained

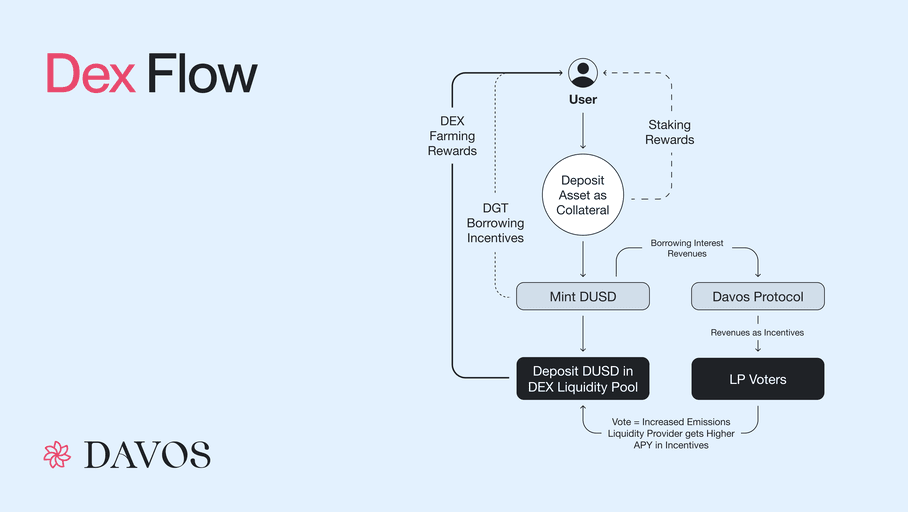

The Dynamic Feedback Loop in Davos is a core mechanism designed to manage the overall ecosystem’s health. It aims to perpetually promote growth and reward all participants involved in the ecosystem.

This loop consists of several interconnected components:

Revenue Redistribution

Davos Protocol doesn’t just keep the revenue generated by borrowing activities; it distributes it throughout the ecosystem. This means that earnings are shared among DUSD liquidity providers, future lenders, and DUSD Saving Rate (sDUSD) participants. By doing so, Davos not only improves the overall sustainability of its protocol but also ensures everyone participating benefits from the protocol’s success.

When richer incentives are distributed, they encourage increased activity within the system. This leads to increased revenue generation, which is subsequently dispersed as further incentives. His self-reinforcing loop of increasing rewards fosters the ecosystem’s long-term growth and stability.

Dex Redistribution Flow (Source)

Dex Redistribution Flow (Source)

Tailored Borrowing Incentives

The Davos ecosystem is strengthened by rewarding users who deposit assets before minting or borrowing the stablecoin, DUSD. The more a specific collateral type is used, the higher the rewards it gets. This way, users earn extra rewards based on the value of their collateral, making borrowing cheaper.

Such incentives encourage borrowing activity, which consequently leads to increased protocol revenue. This revenue increase benefits not only individual users, but also the larger Davos ecosystem, resulting in a mutually beneficial environment for all participants.

Rising APRs and Increasing TVL

Increased Annual Percentage Rate (APRs) in specific liquidity pools is another way davos Protocol draws in additional investors. This ends up making these pools more desirable, resulting in an increase in Total Value locked (TVL).

An increase in Total Value Locked (TVL) in the Protocol leads to better revenues. These higher funds are subsequently repurposed back into the system, not only increasing incentives but also continuously strengthening TVL. This cycle of growth assures that the ecosystem continues to thrive and expand.

Addressing Volatility, Scalability, and Sustainability

Davos Protocol employs several strategies to manage volatility, better scalability, and ensure sustainable growth. Here’s how each challenge is addressed:

- Volatility Management: The Dynamic Feedback Loop helps stabilize the market by adjusting incentives in response to volatility, protecting the ecosystem from market shocks.

- Scalable Revenue Streams: Davos ensures consistent and scalable sources of revenue. Borrowing incentives, combined with borrowing fees work together to fuel a sustainable yield generation mechanism funneled back to ecosystem participants.

- Sustainable Incentive Structures: The protocol establishes economic incentives that are sustainable over the long term, ensuring steady growth without excessive burdens.

- Balanced Rewards: By balancing rewards, Davos maintains user engagement and avoids the pitfalls of unsustainable participation spikes.

By addressing such issues, Davos is not only mitigating immediate challenges imposed by the overall Defi environment but also lays the foundation for long-term stability and growth.

The Summit of Defi: A Sustainable Ecosystem

Davos's Dynamic Feedback Loop represents a sophisticated approach to sustainable DeFi practices. By dynamically adjusting incentives and redistributing revenue, Davos navigates the immediate needs of its users while ensuring long-term protocol growth and stability.

It is time to ascent into a world where your financial ambitions converge with a stable and robust ecosystem. Harness the pinnacle of DeFi by exploring all of our services and utilizing DUSD to climb multiple peaks, establishing diverse revenue streams across both established and emerging landscapes.