Understanding Stablecoins in DeFi: Mechanisms for Stability

Cryptocurrencies like Bitcoin meet almost all the qualities of money—divisibility, portability, durability, store of value, and limited supply. However, they fall short in one critical area: stability. The high volatility of Bitcoin hinders its effectiveness as a medium of exchange, leading to the creation of stablecoins.

Stablecoins were introduced to provide a solution to high volatility, maintaining a stable value by being pegged to more stable assets, such as fiat currencies (ex: USD) or commodities (ex: Gold).

This stability ensures that both merchants and consumers can conduct transactions without worrying about significant value changes from one moment to the next. They can be used for everyday transactions, trading, and as a safe haven during market volatility.

This article will explore the different types of stablecoins, their stability mechanisms, and how they operate as a bridge between traditional financial systems and the innovative world of decentralized finance (DeFi).

Overview of Stablecoins

Stablecoins are a type of cryptocurrency designed to maintain a stable value, typically pegged to a reserve of assets such as fiat currency and commodities. They play a crucial role in the DeFi ecosystem by providing a reliable medium of exchange, a store of value, and a unit of account, facilitating smoother and more predictable transactions.

Evolution and Growing Importance

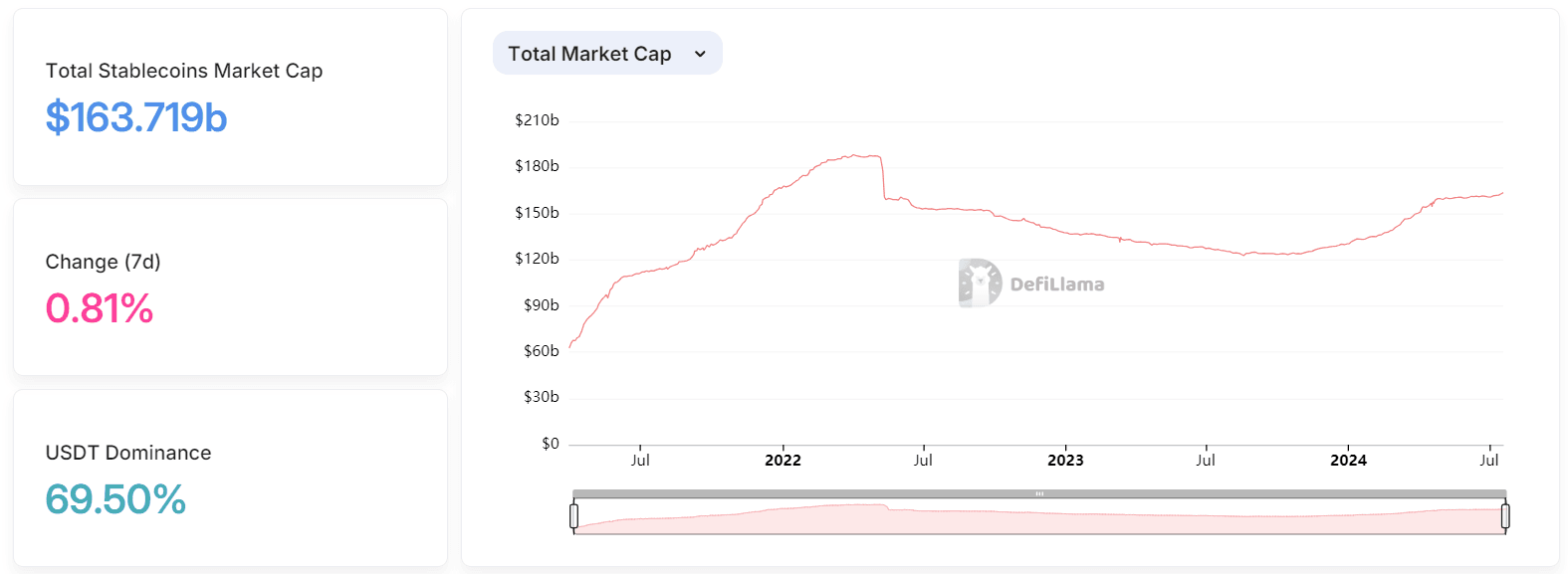

The concept of stablecoins has evolved significantly since their inception. Initially created to provide a safe haven from the volatility of other cryptocurrencies, stablecoins have now become integral to the crypto market. Their importance is underscored by their widespread adoption, with a current total market capitalization exceeding $160 billion as of 2024. This growth reflects their increasing role in facilitating trading, lending, and other financial activities within the DeFi space.

https://defillama.com/stablecoins

https://defillama.com/stablecoins

Types of Stablecoins and Their Stability Mechanisms

Fiat-Collateralized Stablecoins

Fiat-collateralized stablecoins are backed by equivalent reserves of fiat currency held in a bank or a custodian. Each unit of the stablecoin is typically pegged to a fiat currency, like the US dollar.

These stablecoins maintain their peg through the direct equivalence of their fiat reserves. When a user buys a stablecoin, an equivalent amount of fiat currency is held in reserve, ensuring that the stablecoin can always be redeemed for its fiat equivalent.

Examples of fiat-collateralized Stablecoins:

- Tether (USDT)

- USD Coin (USDC)

- TrueUSD (TUSD)

Challenges:

- Regulatory Scrutiny: Regulatory bodies are increasingly scrutinizing fiat-collateralized stablecoins to ensure compliance and transparency (ex: USDC has recently become the first MiCA-regulated stablecoin). - Transparency: Issues regarding the actual reserves backing these stablecoins have led to calls for greater transparency (ex: Tether’s reserves are always taken into question). - Market Dominance: Despite challenges, fiat-collateralized stablecoins dominate the market due to their simplicity and perceived safety.

Crypto-Collateralized Stablecoins

Crypto-collateralized stablecoins are backed by other cryptocurrencies. They often require over-collateralization, where users lock up more cryptocurrency than the value of the stablecoins issued.

Here are some of the stability mechanisms often times used by crypto-backed stablecoins protocols:

- Over-Collateralization: Users lock up cryptocurrencies in a smart contract, which issues stablecoins worth less than the collateral to account for price volatility.

- CDP Protocols: Collateralized Debt Positions (CDPs) allow users to borrow stablecoins against their locked collateral.

- Dynamic Monetary Policies: Some protocols adjust interest rates or collateral requirements dynamically to maintain stability.

Examples:

- MakerDAO’s DAI

- Davos Protocol’s DUSD

Challenges and Breakthroughs:

- Volatility of Underlying Assets: The inherent volatility of crypto assets is a significant challenge.

- Innovations: Dynamic feedback loops and risk-adjusted rates are innovative mechanisms addressing these challenges.

Algorithmic Stablecoins

Algorithmic stablecoins use algorithms to manage the supply and demand of the stablecoin, aiming to maintain a stable value without collateral.

- Supply Adjustments: Algorithms automatically adjust the supply of stablecoins to maintain the peg to the underlying asset.

- Arbitrage: The incentives that exist in arbitrage strategies help stabilize the price by exploiting price discrepancies.

Examples:

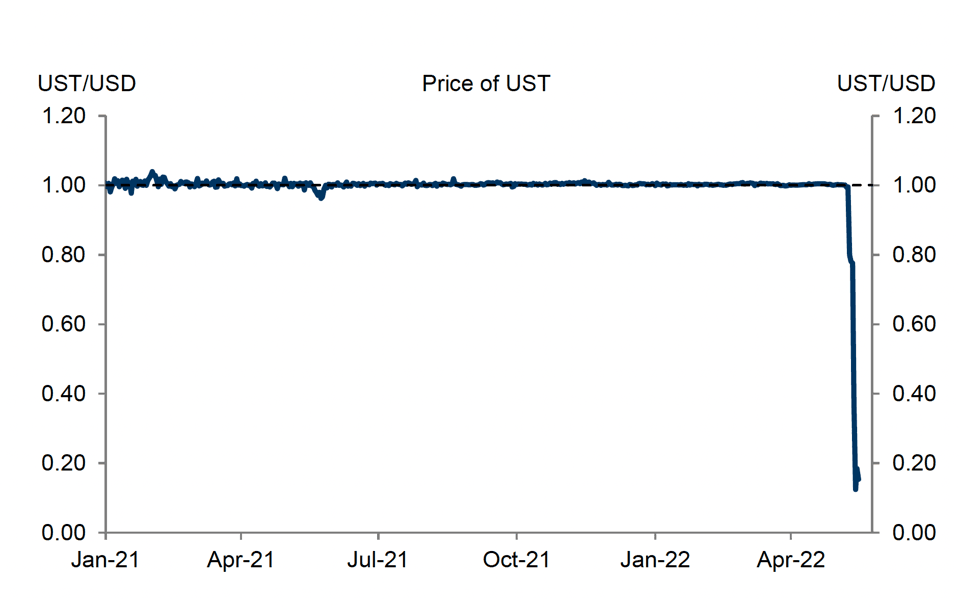

- TerraUSD (UST)

- Ampleforth (AMPL)

Challenges:

- Risks like Death Spirals: The collapse of Terra highlighted the risk of algorithmic stablecoins entering a death spiral. The unsustainability of Terra’s tokenomics was what ultimately led to its downfall.

(Source)

(Source)

For further insight on the challenges of Sustainable Growth in Defi, check out our blogspot about it:

-> The Challenge of Sustainable Growth in Defi

Commodity-Collateralized Stablecoins

These stablecoins are backed by physical assets such as gold, offering a tangible reserve to maintain value.

The stability is achieved through the backing of physical reserves, which can be redeemed for the equivalent value in the commodity.

Examples:

- Paxos Gold (PAXG)

- Tether Gold (XAUT)

Challenges:

- Logistical and Storage Challenges: Storing and securing physical assets can be complex and costly.

- Recent Innovations: Improved auditing and transparent reserve management are addressing some of these challenges.

Comparative Analysis of Stability Mechanisms

Mechanism Effectiveness:

Each stability mechanism has its strengths and weaknesses, often depending on market conditions.

- Fiat-collateralized stablecoins are generally more stable in calm markets but face regulatory and transparency issues.

- Crypto-collateralized stablecoins offer decentralization but struggle with underlying asset volatility.

- Algorithmic stablecoins are innovative but risky, while commodity-collateralized stablecoins provide tangible security but involve significant logistical challenges.

Market Trends:

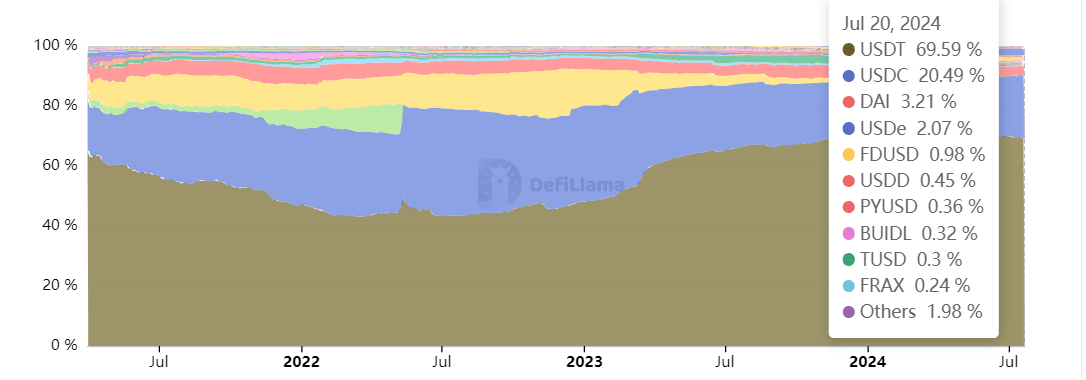

Fiat-collateralized stablecoins currently dominate the market, but innovations in crypto-collateralized and algorithmic stablecoins are gaining traction. The market continues to evolve as new mechanisms and technologies are developed to enhance stability and trust.

Stablecoin Market Dominance (Source)

Stablecoin Market Dominance (Source)

Improving the Stablecoin Sector with DUSD

In conclusion, stablecoins are a cornerstone of the DeFi ecosystem, offering various mechanisms to achieve stability. As the market evolves, understanding these mechanisms is crucial for anyone involved in DeFi.

For more insights and updates on stablecoins and the DeFi space, follow our blog and stay informed about the latest trends and innovations. Explore how Davos Protocol’s DUSD is shaping the future of stablecoins in DeFi.

Join the conversation and be a part of the future of finance with Davos Protocol!