Understanding Inflation and How DeFi Plans to Solve It

Inflation is often likened to a silent thief, slowly eroding the purchasing power of money and affecting the quality of life of millions. As prices rise, each unit of currency buys fewer goods and services, impacting everything from groceries to housing costs.

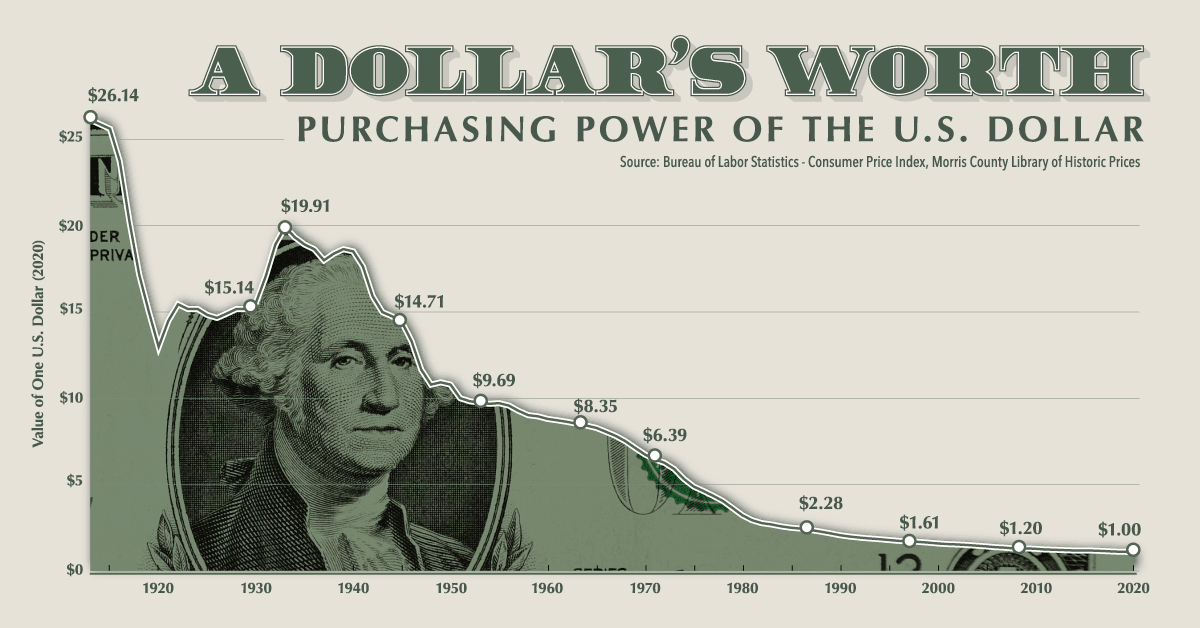

The US Dollar, the number one currency in the world, perfectly illustrates the problem of inflation. Over the last century, the USD has lost 96% of its value. The issue was exacerbated in the 70s after the gold standard, a measure that forced the government to own gold reserves equivalent to the value of every USD in circulation, was abolished by American President Richard Nixon.

(Source)

(Source)

Nowadays, Central Banks and the Federal Reserve try their best to keep the global economy afloat by printing money, a practice technically known as quantitative easing. However, each time new money is placed into circulation, it devalues the currency and considerably lowers the purchasing power of the average citizen. As we will see below, this is one of the factors behind the rampant inflation we see today.

Read below If you wish to learn more about the origins of inflation and how to protect yourself against it. Not only will you improve your financial literacy by reading, but you will also learn how Davos solutions can help you keep your purchasing power intact.

Understanding Inflation

Definition of Inflation

Inflation is defined as the rate at which the general level of prices for goods and services rises, subsequently reducing the purchasing power of money. There are three primary types of inflation:

- Demand-Pull Inflation: Occurs when the demand for goods and services exceeds their supply, often described as "too much money chasing too few goods."

- Cost-Push Inflation: Arises from an increase in the cost of production, which forces businesses to raise prices to maintain profit margins.

- Built-In Inflation: Linked to adaptive expectations, where businesses and workers anticipate future inflation and adjust prices and wages accordingly.

Causes of Inflation

Several factors can trigger inflation, including:

- Increased Demand: When consumer demand outstrips supply, it leads to higher prices.

- Supply Chain Disruptions: Events like natural disasters, geopolitical tensions, and cybersecurity incidents can increase production costs, driving prices up.

- Monetary Policy: As shown in the intro, central banks printing more money leads to a higher money supply, reducing the value of currency and increasing prices. Just to get an idea, roughly 20% of all USD in the money supply was printed in 2020 alone.

Impact of Inflation

Inflation affects various aspects of the economy and personal finance:

- Purchasing Power: As prices rise, the value of money falls, reducing the quantity of goods and services one can buy.

- Savings and Investments: Inflation can erode the real value of savings and fixed-income investments, as the returns may not keep pace with rising prices.

- Cost of Living: Everyday expenses, from groceries to utilities, become more expensive, affecting overall living standards.

How DeFi Combats Inflation

CDP Stablecoins as a Hedge Against Inflation

Collateralized Debt Position (CDP) stablecoin protocols provide a strong inflation hedge by allowing users to mint stablecoins backed by reward-bearing assets. These assets can earn rewards through staking, restaking, and other reward-generating activities, adding a further layer of value preservation and growth potential.

The Davos DUSD is a prime example of a CDP stablecoin. It is pegged to the US dollar and backed by a wide range of reward-bearing collateral types, including Liquid Staking Tokens (LSTs) and Liquid Restaking Tokens (LRTs). These collateral kinds continue to generate rewards even after they are locked up, giving users the advantage of both stability and continued yield generating. This makes the Davos DUSD an effective tool for retaining value in the face of inflation.

To get a better grasp of what DUSD is an how it works, check out our article about it:

-> What is DUSD and sDUSD: A beginner’s Guide

Yield Farming and Staking

DeFi platforms offer yield farming and staking opportunities that can provide higher returns than traditional savings accounts:

- Higher Returns: By participating in liquidity pools or staking assets in Proof Of Stake (PoS) networks, users can earn rates significantly higher than those offered by traditional financial institutions (ex: treasury bonds).

- Risk Management: Advanced protocols and insurance mechanisms can mitigate risks associated with these investments, making them more attractive to users seeking inflation-beating returns.

Decentralized Lending and Borrowing

DeFi platforms facilitate decentralized lending and borrowing, offering several advantages:

-

Access to Liquidity: Users can borrow funds without the need for traditional credit checks or intermediaries, often at lower interest rates.

-

Interest Rate Dynamics: Interest rates on DeFi platforms are typically more competitive and flexible, adjusting based on supply and demand dynamics.

Various different Defi strategies provide a strong defense against inflation by leveraging stablecoins, yield farming, and decentralized lending and borrowing. Collectively, these strategies enable users to preserve their assets from inflation while simultaneously capitalizing on new financial opportunities inside the Defi space.

Help Davos Fight Back Against Inflation

Davos Protocol offers an innovative approach to addressing inflation and ensuring sustainable growth through its Dynamic Borrowing and Monetary Policy. This system aims to provide predictable and sustainable returns by dynamically adjusting borrowing incentives and redistributing revenue within the ecosystem. This approach not only helps users manage inflation risks but also ensures the long-term stability and growth of the Davos Protocol.

Inflation is Here to Stay - And so is Davos!

Inflation is a complex and pervasive economic phenomenon that impacts everyone. However, blockchain technology presents innovative solutions to mitigate its effects.

Stablecoins, yield farming, and decentralized lending are just a few ways DeFi can help preserve and grow wealth despite inflation. Additionally, holding cryptocurrencies like Bitcoin and Ethereum also offers a hedge against inflation, as these currencies are deflationary by nature.

Despite the many existent solutions in DeFi, the Davos Protocol stands out due to its unique approach to dynamic borrowing and monetary policy, a promising solution for sustainable financial growth.