What is Defi? The Ultimate Guide to Decentralized Finance with Davos

What is DeFi?

Decentralized Finance (DeFi) offers an internet-based financial system. DeFi protocols provide various services, replicating traditional finance (TradFi) functions like loans and insurance, and introducing innovations such as yield farming, Liquid Staking, Decentralized Exchanges (DEXs), and stablecoins.

A key advantage of DeFi is its decentralization. Unlike traditional finance, which relies on centralized entities like brokerages, DeFi protocols such as Davos are accessible to anyone, providing defi solutions for the unbanked population.

Here’s a closer look at what is DeFi and how to leverage Davos for its diverse financial opportunities.

Core Principles of DeFi

Let us take a look at the foundational principles of DeFi:

- Decentralization: Eliminating central authorities to allow operations over a peer-to-peer network.

- Transparency: Ensuring that all transactions are visible and verifiable by anyone.

- Permissionless: Allowing anyone, regardless of their location or background, to participate.

- Trustlessness: Relying on smart contracts that execute automatically based on their code, without needing trust in a third party.

- Interoperability: Enabling different DeFi products to work seamlessly across various blockchain networks.

DeFi vs Traditional Finance

DeFi uses smart contracts on blockchains to eliminate intermediaries, enhancing transparency and user control. Unlike traditional finance (TradFi), where transactions are often opaque, DeFi transactions are transparent and auditable by anyone. Smart contracts enable programmable, automated financial solutions, reducing the need for manual processes and legacy systems common in TradFi.

Operates 24/7 with lower operational costs, especially for cross-border transactions, it also promotes community governance through decentralized autonomous organizations (DAOs), giving users more influence over financial protocols. In contrast, TradFi is controlled by centralized institutions, offering less user control and slower innovation due to heavy regulations.

Breaking Down the DeFi Ecosystem

The DeFi ecosystem consists of Defi protocols, platforms, and smart contracts, often referred to as the Internet of Contracts. Key players include developers, investors, users, and DAOs, with Ethereum recognized as the pioneering network in this space.

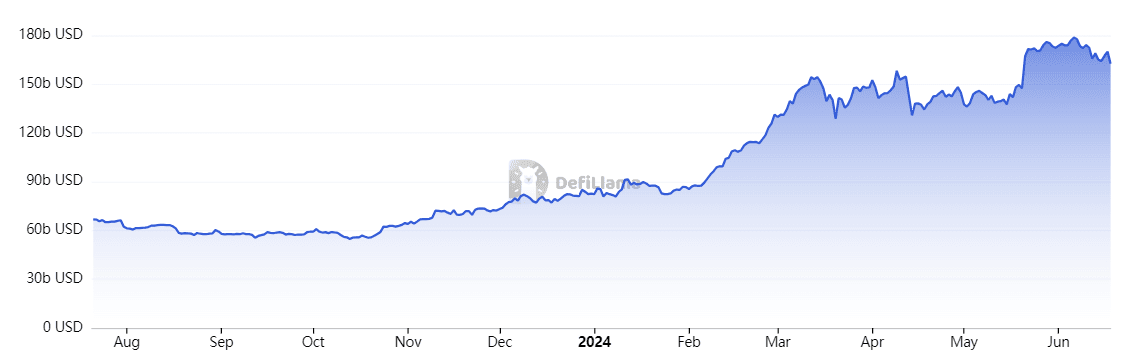

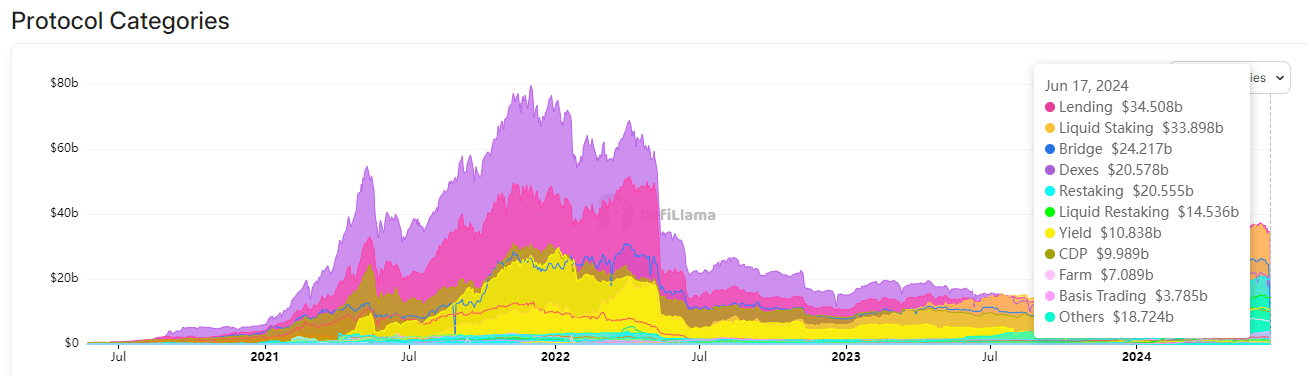

The re-emergence of the Defi Market after a 2-year bear market has resulted in significant developments. Notably, the general market bounce has been supported by a significant inflow of capital into Defi, bringing the Total Value Locked (TVL) to ~$163 Billion this year, up from $54 Billion at the start of the year.

The continuing investment of capital in the billions of dollars highlights Defi’s strength. This year has seen significant growth in nearly every Defi sub-sector, including the smallest ones.

Diversification across sub-sectors has been a clear trend and is critical for Defi to accomplish its ambitious potential of becoming the backbone of Finance. Achieving this requires the creation of a varied range of markets capable of unlocking new financial primitives, allowing users to maximize the value they gain from Defi.

Defi Market TVL Growth (Source)

Defi Market TVL Growth (Source)

According to DeFiLlama, there are over 42 different categories within DeFi. Here is a brief overview of the most important ones:

Decentralized Lending and Borrowing

The DeFi lending sector offers users the opportunity to borrow and Lend crypto in several different ways. Users can issue algorithmic loans, where interest rates change based on supply and demand, Peer-to-Peer (P2P) loans, where borrowers and lenders connect and negotiate terms, or flash loans, allowing users to borrow without collateral under the condition that the loan is both taken out and repaid within the same blockchain transaction.

Platforms like Aave and Compound allow users to lend out their assets or borrow against them directly on the blockchain without needing a traditional bank, earning interest as a lender, or paying interest as a borrower. These platforms are increasingly integrating different types of digital assets as collateral, such as Real-World-Assets (RWA), which, although controversial due to off-chain dependencies, signal a significant trend toward blending traditional finance with Defi.

In 2024, there has been a notable trend in the Market towards using reward-bearing assets as collateral in order to maximize the value derived from borrowed positions. Defi users are increasingly using assets such as Liquid Staking Tokens (LSTs) and Liquid Restaking Tokens (LRTs) to improve their capital efficiency and earnings. This tendency is motivated by a desire to make returns on collateralized assets while also using their worth to obtain loans.

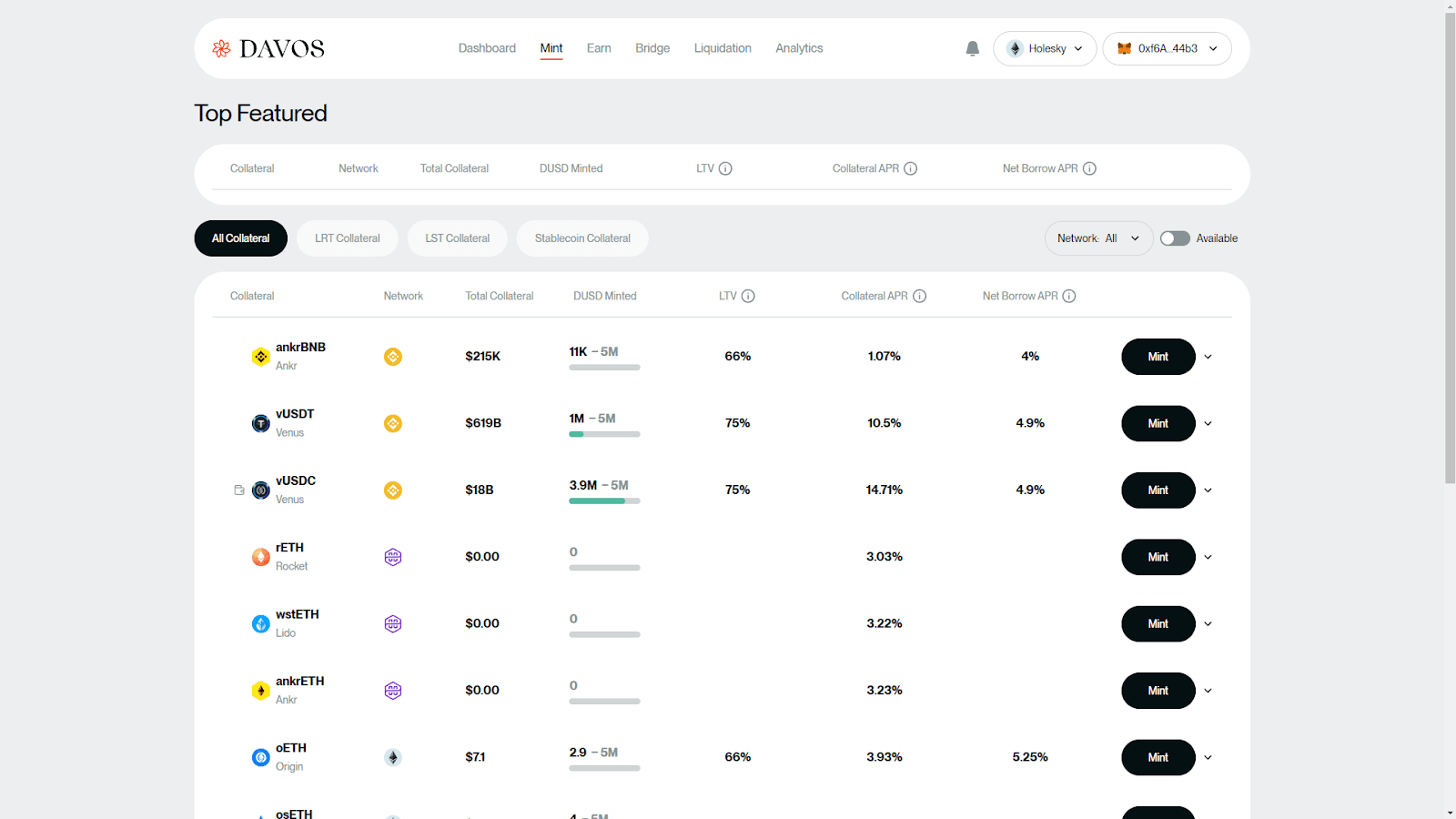

Davos Protocol stands out in this regard as a decentralized borrowing platform, offering fully collateralized loans. As we will see below, Davos enables users to deposit various reward-bearing tokens and mint its DUSD stablecoin in return.

Davos Collateral types for DUSD Borrowing (Source)

Davos Collateral types for DUSD Borrowing (Source)

What are Stablecoins?

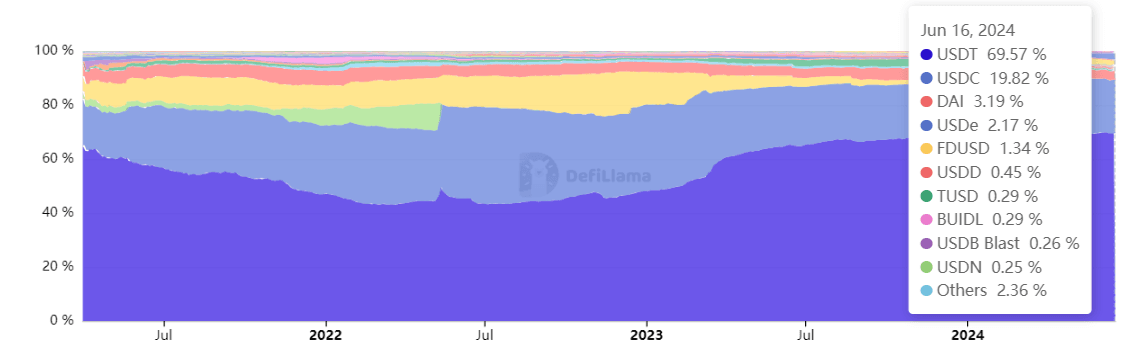

Stablecoins are vital in reducing volatility in the DeFi space, with widespread use across trading, Defi lending, asset management, and numerous other applications. With a market capitalization of roughly ~$161 BIllion, stablecoins make up for about ~6% of the total Crypto Market.

There are three major types of stablecoins, each with their own characteristics:

- Centralized Stablecoins: Backed by fiat currencies like USD or EUR.

- Decentralized Stablecoins: Overcollateralized by other crypto assets, maintaining stability through mechanisms like price oracles for triggering liquidations.

- Algorithmic Stablecoins: Attempt to maintain their peg through algorithmic mechanisms instead of using tangible reserves.

While centralized, fiat-backed stablecoins still dominate the space and will likely remain so for the foreseeable future, the competition has heated up in recent months with emerging protocols entering the market. The rise in popularity of collateralized debt positions (“CDP”) stablecoins for example, which are stablecoins backed by reward-bearing assets, and other stablecoins coincides with an increase in interest in the sector and Defi projects are trying to compete for a piece of the market

Market Dominance of Stablecoins (Source)

Market Dominance of Stablecoins (Source)

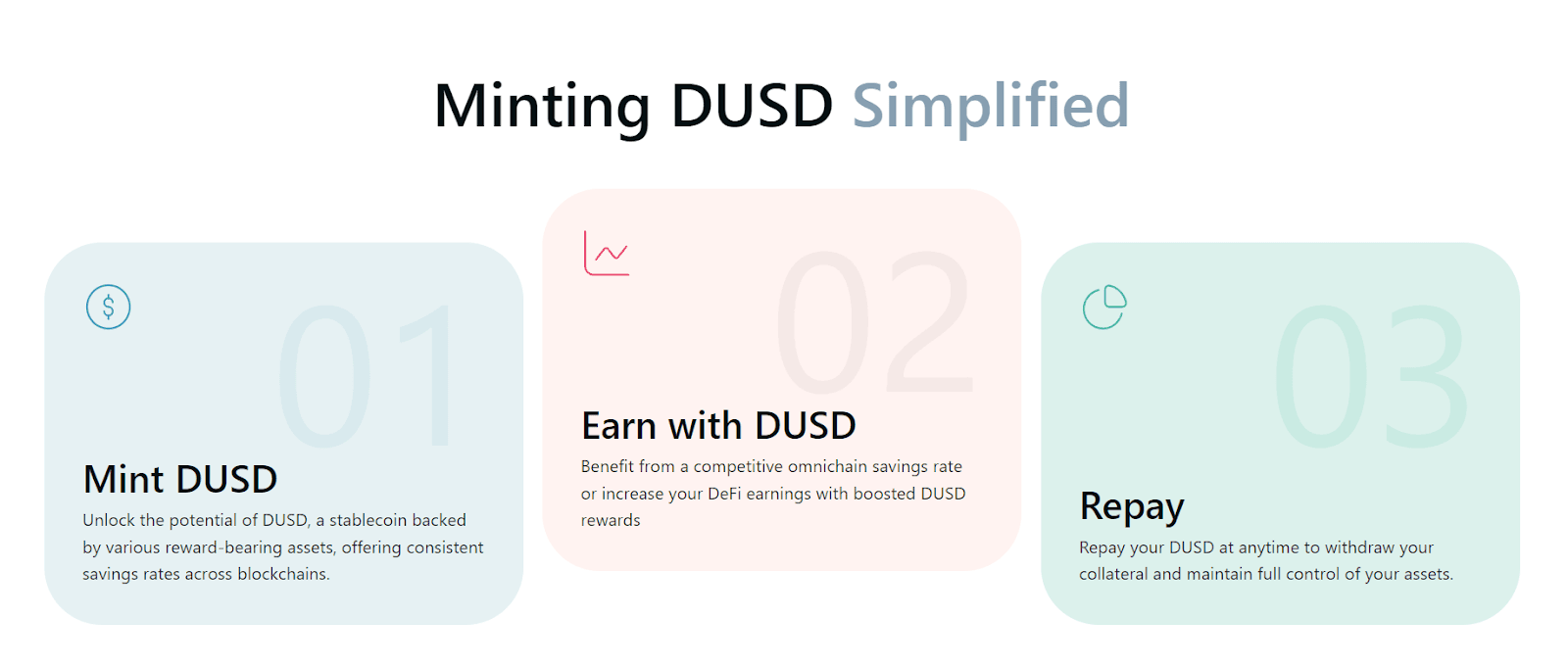

Davos’ Protocol presents itself as a CDP Stablecoin Protocol, which allows users to mint its stablecoin DUSD by depositing reward-bearing assets like liquid staking tokens (LSTs), liquid restaking tokens (LRTs), and similar reward-bearing assets. Along with sDUSD, an innovative omnichain savings rate token, DUSD enables users to mint a stablecoin that’s algorithmically maintained by the value of the collateral deposited on the platform.

Read more about Davos Stablecoin: DUSD, and its Savings Rate here:

-> What is DUSD and sDUSD: A Beginners Guide

Decentralized Exchanges (DEXs)

Protocols like Uniswap enable the trading of cryptocurrencies without a central authority, facilitating direct peer-to-peer transactions with full asset custody.

While Uniswap is the most renowned DEX, users have several alternative options. Holders of DUSD, the stablecoin by Davos, can provide liquidity to Defi DEXs from different ecosystems such as Ethereum, Linea, Optimism, Solana, and BNB Chain. The DEXs include Balancer, Velodrome, Thena, and/or Lynex.

Up to now, Decentralized Exchanges (DEXs) have been the key driver of previous market cycles, accounting for the vast majority of the Total-Value-Locked (TVL), but this is no longer the case, as it can be seen by the graph below:

Defi Categories (Source)

Defi Categories (Source)

Staking

Users can lock up their crypto assets, a process known as staking, to support the functionality and security of a blockchain network. By doing so, they participate in the network’s consensus mechanism, such as proof of stake (PoS), where their staked assets help validate transactions and maintain the network’s integrity.

In return for their contribution, users earn rewards, which come in the form of staked cryptocurrency. These rewards incentivize users to continue supporting the network and can vary based on the amount of assets staked and the network’s specific reward structure.

Liquid Staking

Liquid staking enables users to stake their cryptocurrency assets to earn rewards while retaining liquidity by receiving tokenized versions of their staked assets, which can be traded or used in other DeFi applications.

On Davos Protocol, users can leverage these liquid staking tokens by staking them as collateral for DUSD. By providing assets such as wstETH (Lido), rETH (Rocket), sfrxETH (Frax), ankrETH (Ankr), wOETH (Origin), osETH (StakeWise), and ETHx (Stader) as collateral, users can mint DUSD. This DUSD can then be used in other DeFi endeavors, allowing users to expand the rewards they are already earning on their reward-bearing tokens.

-> Check out all the LST Collateral Options Available on Davos: Davos Mint

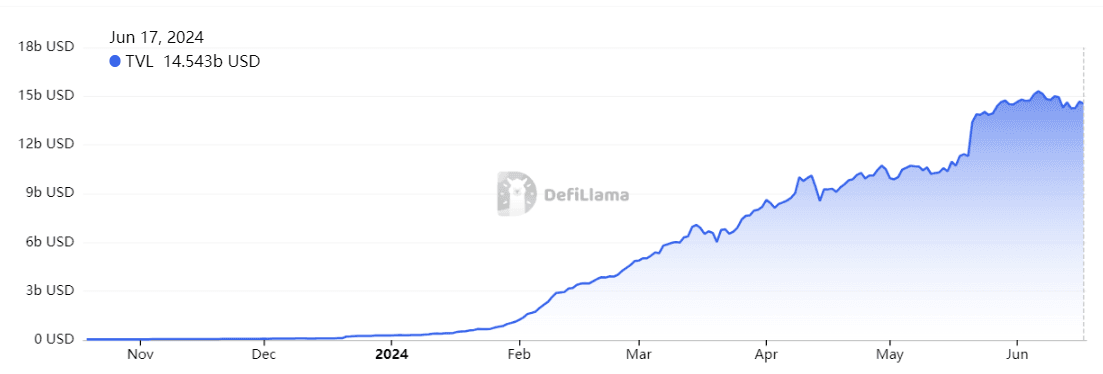

Liquid Restaking

Restaking is a novel concept in the industry, introduced by EigenLayer. It allows users to repurpose their liquid staking tokens (LSTs) or staked ETH to secure a second layer of applications beyond the primary blockchain, thereby earning rewards from both layers.

Restaking aims to address the issue of fragmented blockchain security. Creating enough crypto-economic security can be time-consuming and costly. However, pooling existing security from a large chain, such as Ethereum, can alleviate this challenge.

This DeFi sub-sector has been one of the fastest-growing recently, showing strong signs of interest and popularity. The introduction of liquid restaking protocols, which allow users to remain capital efficient while accruing dual-layer rewards, has significantly expanded adoption in this niche, propelling it to almost $15 billion in total value locked (TVL):

Liquid Restaking TVL Growth in 2024 (Source)

Liquid Restaking TVL Growth in 2024 (Source)

Similarly to liquid staking tokens, Davos users can leverage liquid restaking tokens such as weETH from EtherFi to mint DUSD.

-> Check out all the LRT Collateral Options Available on Davos: Davos Mint

Yield Farming

Yield farming, a key driver of the DeFi Summer of 2020, involves providing liquidity to DeFi protocols in exchange for rewards, which are usually in the form of the deposited token. Users deposit their assets into liquidity pools on decentralized exchanges (DEXs) or lending platforms, facilitating activities like trading, lending, and borrowing. In return, users earn rewards from trading fees, interest, or additional incentives provided by the protocol.

Davos enables its users to leverage yield farming by using DUSD in various liquidity pools on platforms like Aura, Lynex, or Velodrome. By depositing DUSD into these LPs, users earn multiple rewards, including a share of transaction fees and additional incentives in the form of platform tokens. These rewards can be harvested and either reinvested or used elsewhere in the DeFi ecosystem.

-> Explore all Yield Farming opportunities with DUSD on Davos: Davos Earn

Benefits and Risks of DeFi

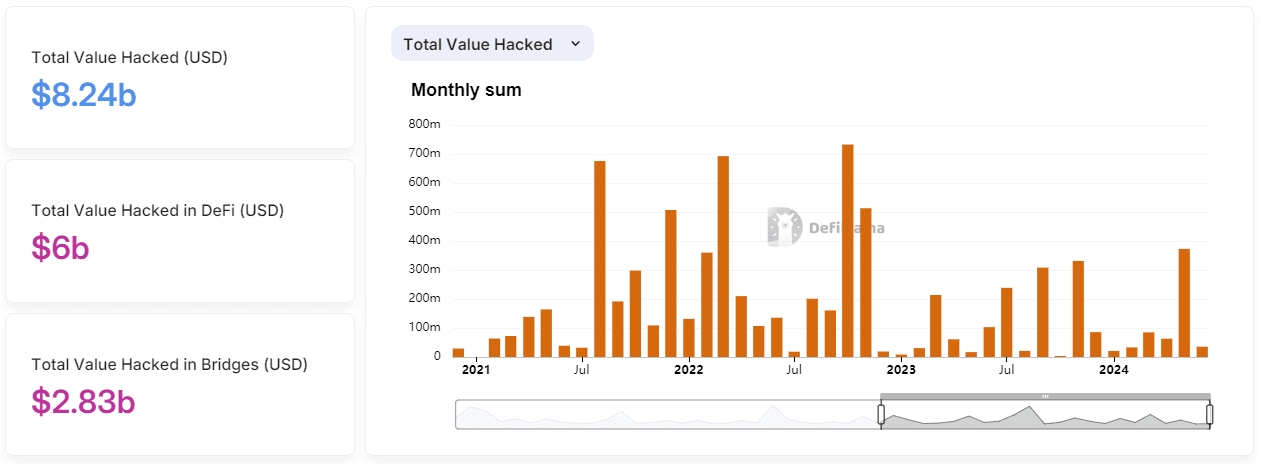

While DeFi offers accessibility, increased security, and financial sovereignty, it also faces challenges like the inherent volatility of crypto markets and stringent regulation applied by the U.S. government, which may end up stifling growth and innovation.

Smart contract vulnerabilities are also one of the largest problems plaguing the industry, with DeFi protocols being a prime target for hackers. According to DeFiLlama, DeFi protocols have fallen victim to numerous hacks over the years, totaling a staggering $6 Billion in losses.

Hacks in Defi Data (Source)

Hacks in Defi Data (Source)

However, the rise of decentralized insurance protocols is mitigating risks associated with smart contract vulnerabilities and platform failures, improving the overall trust in DeFi platforms.

The Future of DeFi

The DeFi sector is experiencing a transformative phase, marked by several key trends that are reshaping its future. One of the most significant trends in DeFi is the deepening integration with traditional financial systems, with a recent case being the Bitcoin and Ethereum ETF approvals. This convergence is driving universal accessibility to financial services, enhancing efficiency and inclusivity.

Technological innovations, particularly in cross-chain technology and Layer 2 solutions, are also pivotal. These solutions facilitate asset and data transfer across different blockchain networks, addressing scalability issues and reducing dependency on any single blockchain, making DeFi more accessible and efficient.

As DeFi continues to evolve, it is set to offer more sophisticated financial instruments and services, expanding its reach within global finance thanks to Davos and other prominent protocols.

With pioneer features like the omnichain Savings Rate token (sDUSD), a multitude of collateral options for DUSD minting, and a multi-blockchain presence through the Davos bridge, Davos is setting new standards in ensuring stability and user empowerment across all EVM-compatible chains.

How to Start in DeFi?

Get started with Davos and DeFi in four simple steps:

1 - Getting started typically involves setting up a web3 wallet, like Metamask or TrustWallet.

2 - Next, it is advised that we understand the basics of self-custody. Unlike centralized exchanges like Binance and Coinbase, web3 wallets place users in control of their own funds. Essentially, this means it is necessary to manage seed phrases, a 12-word phrase master key to the wallet.

3 - We advise users to be extra wary whenever connecting the wallet with web3 protocols, always ensuring you access the correct URL and that the wallet is synced to the correct blockchain before any interaction.

4 - Once that is all done you can enjoy all the benefits Davos has to offer. Start exploring by staking with Davos, minting DUSD, and using it across several ecosystems to compound rewards and become eligible for future airdrops.

Minting DUSD Process (Source)

Minting DUSD Process (Source)

Start using Davos today! For more detailed insights on how you can explore the vast DeFi ecosystem on Davos, check Davos' official website and the latest updates.