What is DUSD and sDUSD: A Beginner's Guide

The financial industry has been revolutionized by the emergence of decentralized finance (DeFi), offering a broad range of financial services and investment opportunities beyond traditional banking systems.

DeFi's significance lies in its ability to democratize financial services, making them accessible and flexible to anyone with an internet connection. However, navigating the volatile crypto market in search of stable yet profitable opportunities poses a significant challenge for many.

This is where stablecoins like DUSD and its yield-bearing counterpart, sDUSD, come into play, providing a blend of stability and profitability.

Understanding DUSD

Acting as the cornerstone of Davos Protocol, DUSD is the perfect currency for investors looking to find stability in the volatile crypto landscape.

As a stablecoin, DUSD is designed to maintain a stable peg to the US Dollar. This means DUSD is always worth $1, maintaining constant value since its inception in February 2023.

The stability offered by DUSD is crucial, enabling users to engage with financial services without the added risk of fluctuating values. This makes DUSD the ideal solution for transactions and other actions within Defi, such as lending and borrowing.

The protocol maintains or exceeds the Federal Reserve's borrowing interest rate, ensuring a competitive savings rate for DUSD across multiple blockchain networks (Ethereum, BNB Chain, Polygon, Arbitrum, and Optimism).

Looking ahead, version 2 of Davos Protocol is expected to further expand its capabilities. This major upgrade will bring in the 'All-weather savings rate,' which is intended to be resilient in a range of economic scenarios and redefine the borrowing rate mechanism currently seen in DeFi.

Stay tuned for more details on this significant update, which looks to solidify DUSD's position as a front-runner in the stablecoin market.

The Advantages of sDUSD

sDUSD, a core offering from Davos, is an ERC20 token that offers a viable option for DUSD holders aiming to earn extra yield.

With the help of this financial tool, DUSD holders can take part in a decentralized savings structure and profit from their holdings while maintaining liquidity.

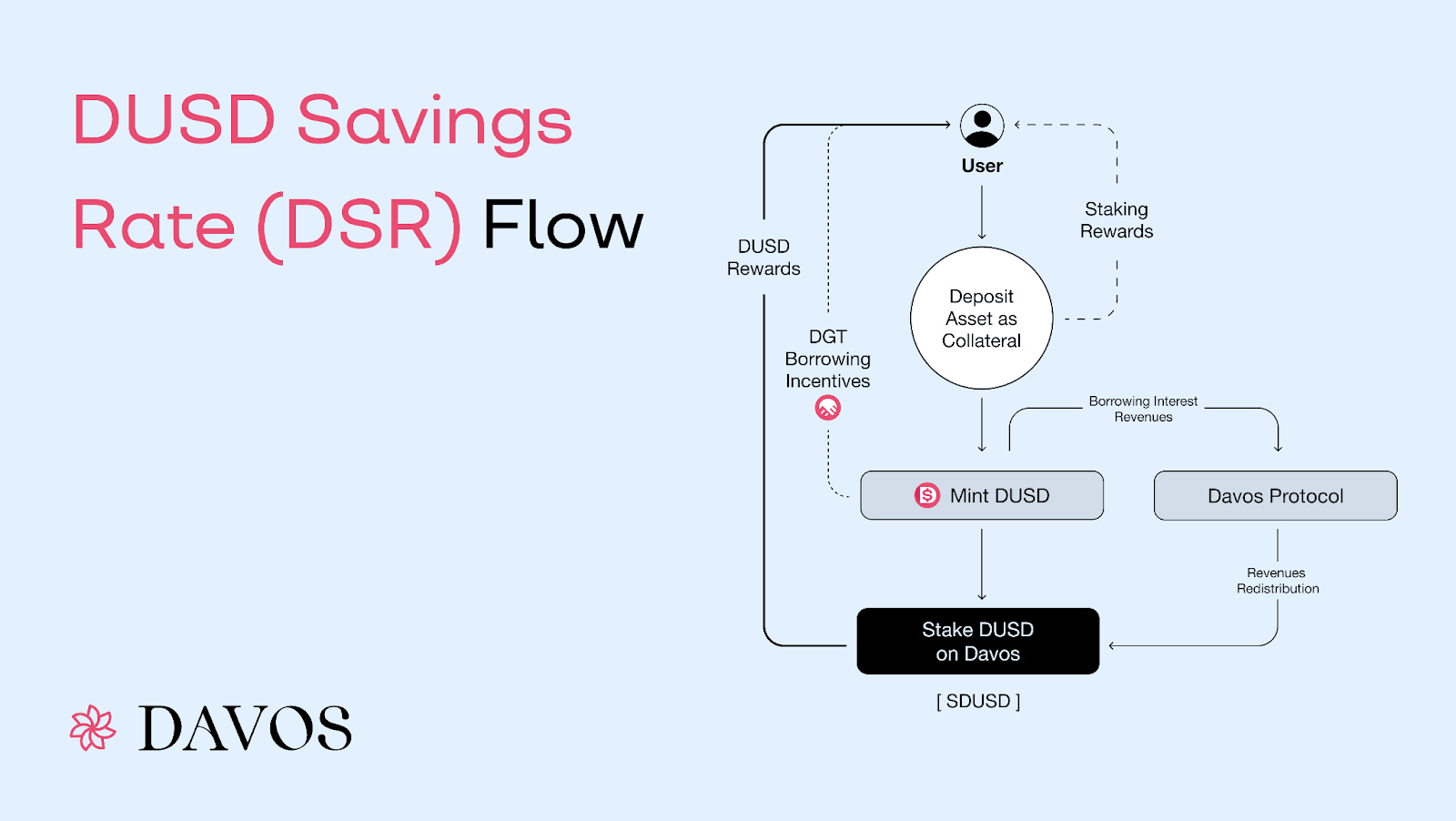

[1] - DUSD Redisitrbution Structure through sDUSD

[1] - DUSD Redisitrbution Structure through sDUSD

This financial instrument transcends the Ethereum Blockchain, offering omnichain functionality. This means that, similarly to DUSD, sDUSD can operate across multiple blockchain networks, expanding its utility and accessibility within the DeFi landscape.

The alignment of borrowing rates with the Federal Reserve's rates ensures stability and predictability of returns, making sDUSD an attractive option for users seeking reliable investment opportunities. Additionally, the protocol offers flexibility in staking and unstaking DUSD and sDUSD, promoting a permissionless and fluid interaction.

Features of DUSD and sDUSD

Staking Mechanism

DUSD holders have the opportunity to stake their holdings in exchange for sDUSD, thereby unlocking the potential for extra yield rewards. Through the use of this staking mechanism, DUSD becomes a more useful and dynamic financial instrument in the Defi Space.

Earnings Distribution

The Davos Protocol has devised a system to distribute earnings to sDUSD holders, which is intricately linked to its lending and borrowing dynamics. This distribution mechanism ensures sDUSD holders become eligible to receive a percentage (5%) of the fees generated by the Davos Protocol.

Stable Price Mechanism

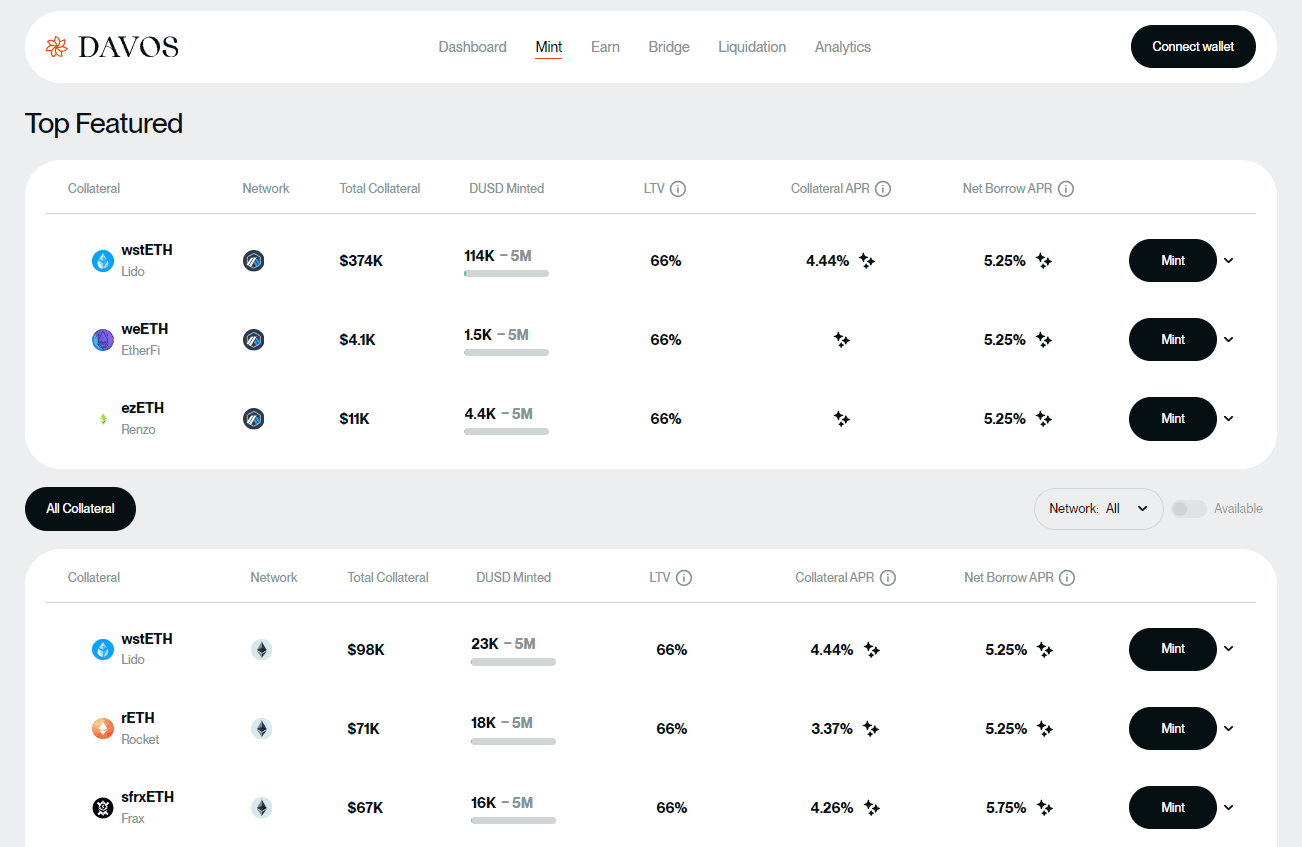

DUSD stability is achieved thanks to Davos’ unique architecture, where LSTs (Liquid Staking Tokens), Liquid Restaking Tokens (LRTs), and other reward-bearing assets are used as collateral to ensure DUSD’s peg.

[2] - Davos Dashboard for DUSD Minting (Source)

[2] - Davos Dashboard for DUSD Minting (Source)

Using a high Loan-To-Value (LTV) ratio and a 150% over-collateralization model, our protocol ensures DUSD holders remain protected against price crashes and unforeseen swings.

Additionally, whenever investors take advantage of arbitrage opportunities, profiting out of price differences in DUSD, they are actually contributing to a stronger peg on the stablecoin.

Yield Origins and Dynamics

The yield on sDUSD is directly tied to borrowing rates and key financial indicators within the Davos Protocol. This linkage makes the yield dynamic, reflecting the prevailing economic conditions and the protocol's performance.

Value Appreciation

sDUSD offers a unique advantage through value appreciation over time. Unlike traditional tokens, sDUSD's design enables it to accrue yield continually, thereby increasing in value and offering holders the potential for capital appreciation.

Omnichain Functionality

The multichain presence of DUSD and sDUSD underscores their versatility and broad accessibility across the DeFi space. This omnichain functionality allows users to engage with these tokens on various blockchain platforms, enhancing their utility.

Zero-fee Structure

Engaging with the sDUSD contract is remarkably cost-effective, thanks to our zero-fee structure. This design choice removes barriers to entry and participation, making it more appealing for users to stake DUSD and earn yields through sDUSD.

Navigating the turbulent DeFi waters with Davos’ Offerings

Both DUSD and sDUSD represent significant innovations in the DeFi sector, offering a viable and stable investment vehicle. For those navigating the volatile crypto market, these tokens provide a secure and profitable avenue for investment and earnings.

As the blockchain landscape continues to evolve, the Davos Protocol remains at the forefront by offering solutions that align with the needs of modern investors. Take a step towards a more stable and profitable DeFi experience and experience all that DUSD and sDUSD have to offer!