The Challenge of Sustainable Growth in DeFi

The decentralized finance (DeFi) space has seen rapid growth during its seven-year existence, transforming from a niche market into a significant segment of global finance. However, due to the cyclical and volatile nature of crypto markets, this explosive expansion brings forth substantial challenges that DeFi protocols must overcome to achieve sustainable growth.

In this article, we’ll be analyzing the requirements to achieve sustainable growth and bring stability to the DeFi ecosystem.

Overview of DeFi and its Growth

Defining DeFi

DeFi refers to financial services built on public blockchains, primarily Ethereum. These services include lending, borrowing, trading, insurance, and earning interest on crypto assets without relying on traditional financial institutions.

For a complete scoop of Defi and what it has to offer, check out our most recent guide:

-> What is Defi? A The Ultimate Guide to Decentralized Finance with Davos

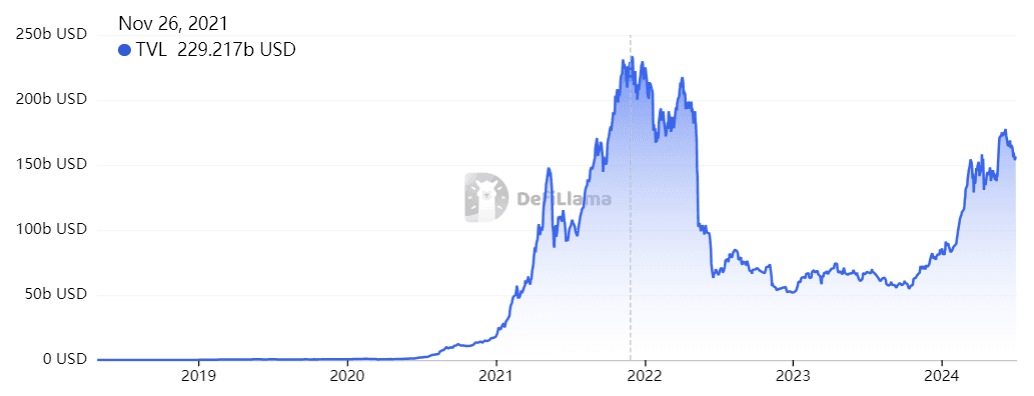

History of Exponential Growth in Defi TVL

The total value locked (TVL) in DeFi protocols breached the $1 billion mark in June 2020, during the yield farming craze of the 2020 DeFi Summer. From then on, TVL skyrocketed throughout the 2021/2022 bull market, peaking at roughly $220 billion in November 2021:

(Source)

(Source)

Today, the TVL is sitting at roughly $157 billion. As we approach the next phase of the current bull cycle and the Ethereum ETF nears its launch, there is a strong probability that TVL will continue to grow and register a new all-time high in the coming months.

But regardless of the market’s future performance, the astonishing growth already witnessed is indicative of DeFi's potential to revolutionize traditional finance by making financial transactions more efficient, transparent, and accessible.

Key Challenges to Sustainable Growth in DeFi

Market Volatility

The inherent volatility of the crypto market significantly impacts DeFi, especially during Black Swan events. During the Covid Crash ("Black Thursday") in March 2020, the value of many cryptocurrencies plummeted, causing massive liquidations and losses across various DeFi protocols.

This event highlighted the fragility of DeFi systems in the face of extreme market conditions. Unlike traditional finance, where regulatory mechanisms and central banks help stabilize the market, DeFi operates in a highly volatile and decentralized environment.

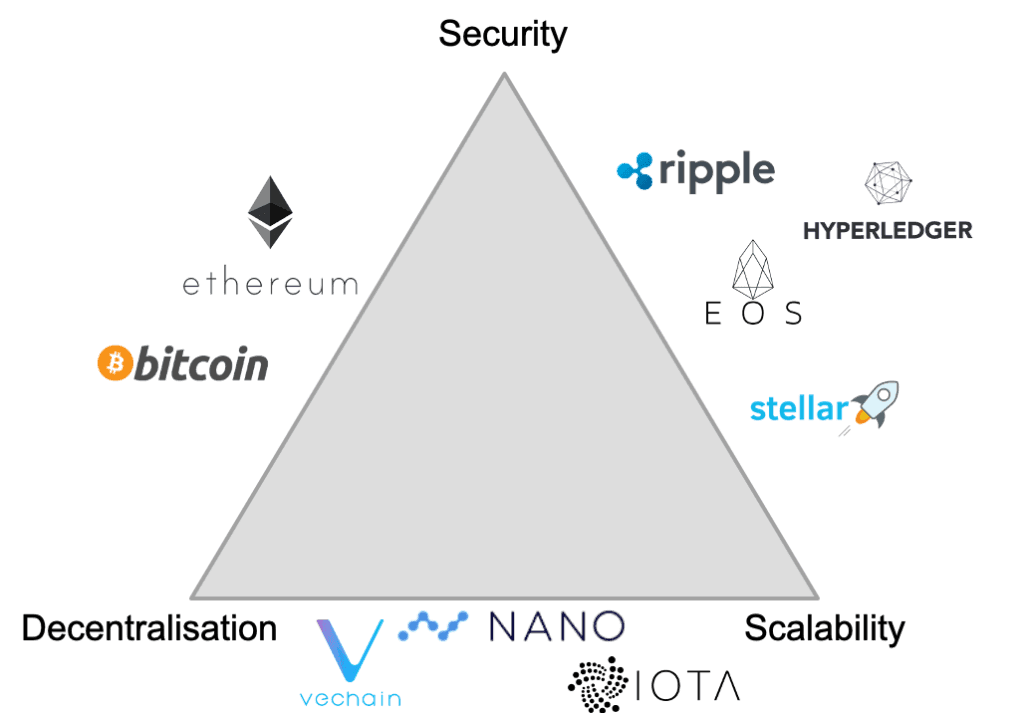

Scalability Issues

Scalability remains a critical challenge for DeFi protocols. The blockchain trilemma—balancing security, decentralization, and scalability—poses significant hurdles. During Ethereum's "DeFi Summer" in 2020, transaction fees skyrocketed due to network congestion, making it expensive for users to interact with DeFi platforms.

The Blockchain Trilemma (Source)

The Blockchain Trilemma (Source)

Scaling solutions, such as layer 2 networks (e.g., Arbitrum), are helping Ethereum and other networks to address these issues, but they are still in their early stages.

Economic Incentives and Sustainability

DeFi protocols often rely on economic incentives like yield farming to attract and retain users. However, these incentives can prove themselves unsustainable in the long run.

A notable example was SushiSwap, where overly generous rewards led to an initial surge in participation, followed by a severe backlash and a decline in the protocol's stability. Sustainable incentive structures, backed by sound tokenomics, are crucial for the long-term viability of DeFi projects.

The Need for Innovative Solutions

Creating a sustainable DeFi ecosystem is vital for its long-term success. Innovative solutions such as the Davos Dynamic Feedback Loop Model aim to address these challenges by ensuring stability and sustainability in DeFi protocols.

This model will be explored in-depth in our upcoming article, as we’ll demonstrate how Davos has contributed and will continue to contribute to a more resilient and stable DeFi ecosystem. Stay tuned!

Building a Sustainable Future

The DeFi space holds immense potential to transform the financial landscape. However, addressing market volatility, scalability issues, and economic incentives are crucial to ensure the long-term success of any protocol.

The fact of the matter is that crypto is a relatively new market. Over time, it’s expected that volatility will become less pronounced and new technological solutions will take place, furthering the appeal of DeFi to global audiences.

Accompany DeFi’s evolution with Davos. Learn how our dev team is tackling these challenges to build a robust and sustainable DeFi ecosystem. For more insights, visit our protocol’s main page and follow us on Twitter (X):

##DeFi Market Growth: Prediction and Adoption for next years

-> Visit Davos

-> X (Twitter)